Looking back on 2023: Fintech Horror Stories

A throwback to end the year, featuring Huntington, Shellpoint, Sunbit, Varo, and One Finance

As a tribute to the original name of our newsletter, and also because we haven’t done this in a while, I thought it would be fun but also sobering to take a look at some of the year’s most egregious fintech horror stories, sourced from various places (CFPB complaint database, Twitter, Better Business Bureau, etc) and our analysis of the complaint. It should be clear that we can’t verify whether or not these events actually happened as the customer narrates, but where there’s smoke there’s typically fire (especially with CFPB complaints and based on how the institution dispositions the complaint). Let’s begin:

Huntington National Bank - Debit Card Fraud Protection (Oops, just kidding).

This is an alarming story. When banks and institutions tell you that they offer “100% fraud protection with zero dollar liability,” that isn’t necessarily true. If they do an investigation and find that in their opinion, there was no fraud, they will push back on you and claw the money back. As in the above case, this can force consumers to have to go to draconian lengths to prove they weren’t liable and didn’t make the fraudulent charges, as the above person did by getting camera footage of them at work and trying to use it along with filing a police report. In the end, fortunately filing the CFPB complaint was able to make them whole and force the institution to acknowledge it wans’t their fault. Worth noting, this seems to be a common refrain with Huntington (2 more cases in that thread).

Shellpoint Mortgage Servicing - No worries, we got your payment, it’ll post, we promise

This is just being lazy or miscommunicating or something worse happening within the walls of this company. Customer had set up payments in advance presumably to be withdrawn from their account in the form of ACH. When it didn’t post, they received an unwelcome email telling them their payment was late. Called Shellpoint who assured them it was a mixup, the payment was received and just hadn’t been posted, an email would be sent and all would be well and to call back on a certain day. Certain day arrived, and customer called again - same response. At the third day, the person finally decided it was time to write to the CFPB as they’re concerned about their credit situation. These sorts of experiences are a good reminder that no matter how nice and fluffy their Instagram pages are, many of these companies are upfront and honest about their goals, and it’s not to “make customers whole,” it’s to make money or in this case “collecting principal, interest, and escrow payments” which is literally the opening statement on their website when you search for them.

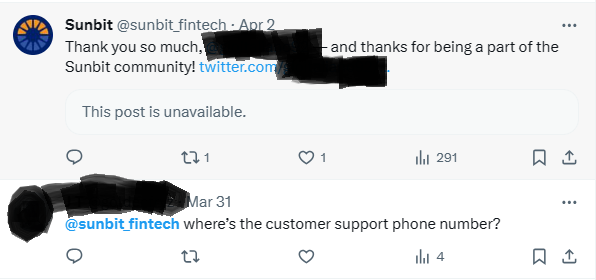

Sunbit - Buy Now, Pay Later, Respond Never

There’s more after that, but you get the idea. Touted as one of the year’s fintech success stories in the BNPL space that really bucks the trend of companies in that niche with “exploding” search growth status, unfortunately, they seem to be completely unwilling to respond to their customers on Twitter. You could argue they don’t have any obligation to do this, but to me it seems almost comical in the first example that they don’t have time to respond to a customer asking a simple question, but they have time to respond to someone giving them praise. It’s not like they are getting a lot of questions either, which would prevent them from tackling this. As we’ve noted in the past, this sort of behavior usually signals a sign of things to come. Will be interesting to see how things develop as this company grows further.

Varo Bank - Direct (Delayed) Deposits

Background - Varo is a bank that specifically targets lower income folks, who have had bad experiences with more traditional institutions. One of the services they offer is early payday - how this works is Varo figuring out some pain points in the direct deposit process and specifically in the ACH process; when employers report to the Federal Reserve the amount of payroll they will be disbursing to employees, the Fed will then circle back to institutions and share that information with them along with when they can expect employers to place funds in their account. Varo claims that they can leapfrog this process by disbursing funds right as they get the notification from the Fed instead of waiting for the ACH to come through from the employer. And generally, it tends to work, especially for those folks who would love to get their paycheck sooner as they live paycheck to paycheck.

So what has wrong recently? Let’s go with a timeline of events to give you an idea of what happened/continues to happen:

February 2 - multiple folks on Twitter complain about not receiving their direct deposits when they expected; indicating they are Varo customers:

Varo acknowledges some (but not all) of these folks, saying they’re “working diligently” without directly admitting there’s a problem.

All seems to be resolved and beyond 1-2 messages, things seem to calm down. Then four months later…

On and on…you get the picture. After a string of angry customers and tweets, Varo finally fixes the problem and announces as such:

Then literally one week later:

With tons more messages complaining and them semi-acknowledging a problem this time. You get the idea. They fix it.

This happens again on August 25 (this is a big one given they acknowledge an issue again), and who knows how many other times that weren’t reported on Twitter. While companies have these kinds of issues occur, the frequency with which this appears to happen for them is pretty alarming and is a bit more than just “our website was down”. What makes it worse is this egregious example of servicing:

Yeah, you saw that right. Customer complains, give a canned response, complains again, give the same canned response. This company raised a $500 million round over two years ago and has received almost $1 billion in funding in their lifetime and is at Series E, probably hoping to go public soon. Perhaps they should put some of that money towards improving their customer service and their direct deposit processing before they get carried away with those dreams.

One Finance - Where has the time gone

This fintech is probably best known for being acquired by Walmart and being touted as a means for them to signal that they may try to go into banking (which in and of itself is a no-no, as the Bank Holding Company Act of 1956 prevents companies from stating they are a bank and a business doing commerce at the same time). It should be noted that their actual banking product is provided by Coastal Community Bank, and One just provides the servicing. However, if they are “just” doing servicing, it seems they could use some work on their general complaint handling (especially when their longtime customers already are not too thrilled and such stories have hit the media). A visit to the Better Business Bureau page sheds some interesting light on the story. One thing we should note before moving forward is that BBB expects businesses to respond to complaints filed with them by consumers within 14 days. Failure to respond (and presumably delayed responses as well) can impact a company’s BBB rating. Rather than regale you with screenshots, I think a bit of analysis of BBB data tells us a few things:

From April 2021 (when they were still independent) until December 2022, One had just over 30 total complaints posted on their BBB page.

From January 2023 until April 2023, One had 9 complaints on their BBB page, which they were able to resolve in about eight days on average, well within the 14 day BBB timeframe.

From April 2023 until present day, One racked up 78 complaints. For context, One received more than double the number of complaints they had received in the past two years, in just eight months.

Watching the progression of the average response time per month is also something:

May 2023 - 17 days

June 2023 - 17 days

July 2023 - 22 days

August 2023 - 24 days

September 2023 - 19 days

October 2023 - 23 days

November 2023 - 23 days

Why is this important? This data can allow any average person to root cause the deterioration of a company’s customer service in real time. After a stellar record of responding to customer complaints within expected time frames and having a relatively low number of complaint volume generally, something goes wrong in April or May and suddenly not only have complaints skyrocketed but their customer service can’t resolve complaints in a timely fashion. Root cause? Speculation here, but more than likely given Walmart’s announcement of cutting store locations, I’d be stunned if there wasn’t internal headcount reduction for One and a small batch of folks are having to hold down the servicing fort all on their own. We’ll see where things go with this institution.

~~~~

We should be clear, we’re not trying to dog these fintechs unnecessarily, but especially with SVB in our rear view, scrutiny on the banking and fintech space is probably at an all time high. If you’re a company, no matter how large or small, and you are touting how you’re helping disadvantaged consumers, do yourself (and the customer) a favor and get your house in order. Inflation may be cooling, but folks are still struggling.

Wish everyone a happy belated holiday, happy early new year and see you in 2024!