Fintech Horror Stories - The SEC has had Enough

Or that’s what they want you to think.

Sorry for the delay on this, folks! If I’m being honest, digging through the pair of formal actions the SEC issued against Binance and Coinbase this past weekend has been way more involved than I expected (and this analysis post coming way later than I had hoped). But as promised, we are going to dive into them. Since both of these documents are very large (136 and 101 pages, respectively), I thought it would help to try to address both of them in a Q&A format to see if we can make sense of them while simultaneously deep dive into why they are such a big deal. So without further ado, here we go:

~~~

In layman’s terms, what happened with Binance, Coinbase, and the SEC?

I thought NPR did a decent job of summarizing this. “The Securities and Exchange Commission unveiled a barrage of charges against two of the world's largest crypto exchanges — Coinbase and Binance — kicking off a legal battle that will help define the future of cryptocurrencies.” They also add: “Gensler believes most cryptocurrencies are securities, and as such, current laws give his agency the power to regulate them, and the sites and apps on which they are bought and sold. Although these two lawsuits are different in many ways, at their heart, Coinbase and Binance are both being accused of failing to register their exchanges with the SEC…If the SEC prevails in the courts, it could potentially force crypto companies to register with the SEC, which would be a sea change.”

Okay, those are the headlines. What’s really going on?

It depends who you ask. If you ask the SEC, which gets to convey the “official side” of the story, it’s exactly as you read above. Binance and Coinbase are operating without the appropriate registrations, and that’s that. However, there’s a whole lot of other stuff that is worth noting, which many crypto advocates are pointing out:

Gary Gensler, the SEC chairman, applied to serve as advisor to Binance before taking on his SEC role. This is something that Binance revealed as part of their court filing in response to the SEC’s case here, asking that Gensler’s actions be considered void since he must be recused due to a conflict of interest. However, I’m not exactly sure what Binance is trying to imply as Gensler certainly isn’t advocating in their favor and if anything, him acting against them actually disproves any conflict of interest just by his actions alone.

A respected name in the crypto world shares an interesting perspective:

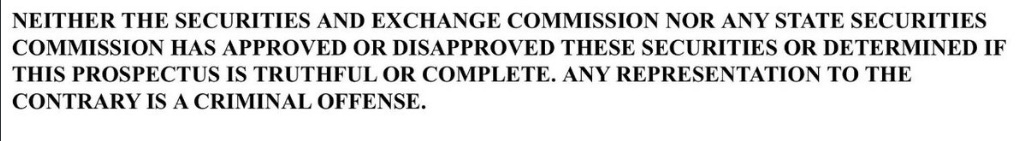

However, as my own experience with regulators can attest, regulators don’t “approve” anything. They give a non-object which is about the most blasé way of saying “you sent us something. Thanks.” I’ve run into this with many clients in the past who have thought that regulators acknowledging receipt of a company’s remediation of an issue they raised, for example, constitutes their approval, when it doesn’t because they still have to validate. Indeed, this was attached to Coinbase’s S-1 (which is a pretty big omission for the above lawyer to not note before making his bold statement):

So if this isn’t a grand conspiracy, what’s the real story? The truth, as always, lies somewhere in the middle:

Putting aside the outrage, there’s a lot that Binance and Coinbase have done that is plain and simply not sustainable (Coinbase less so, as we’ll discuss later). However, the SEC is a tool of the federal government and like most regulators, has a stake in looking good and serving larger political agendas (not necessarily for one party or another).

On that note, one thought that comes to yours truly’s mind is this - the government likely appreciates the power of the technology behind cryptocurrency, but they don’t appreciate the complete decentralization and the unprecedented privacy for the end user. Thus, one might consider that a Central Bank Digital Currency is the endgame. Indeed, it’s what other names are thinking:

The problem with this view is that the US hasn’t shown much interest in going down this route even if they have issued some white papers on the matter, and even if they did, the other markets where CBDCs are taking off have governments that seem to be crypto-friendly. Indeed, other voices in the crypto space caution that FedNow has nothing to do with CBDC. You can dig into these viewpoints further at the links shared above or by finding your way to the twitter pages/feeds of the accounts I noted. My disclaimer is that I’m not a crypto expert and not a lawyer, but I am interested in consumer protection. And fascinatingly, there is almost no mention of AML/KYC in this discussion which is where I really get excited.

Now, with that said…let’s dig into what the SEC has actually said in their cases, regardless of what you believe their motive is or their long-term agenda after filing.

Which company is in hotter water?

By far, Binance is in bigger trouble here. Comparing the two filings, the SEC uses much stronger language with Binance on the opening page, accusing it of “blatant disregard” while for Coinbase, it starts the filing by simply setting the stage/offering background. The SEC has also made 13 claims of relief against Binance vs only 5 for Coinbase.

What are the issues and how do they compare?

Both companies are accused of operating without the appropriate registration; demonstrating the SEC’s belief that cryptocurrency tokens are securities and thus fall under purview of regulation, registration and disclosure, all for the sake of investor protection. Beyond that, Binance is accused of improper controls management including how they were advertised to customers, promising to restrict US residents from using a non-US version of their site, commingling personal funds with those funds entrusted to them by their customers, having poor privacy and security safeguards in place, and having a limited ability to prevent fraud. Coinbase, on the other hand, has as its additional charge an improperly established staking program (which we’ll talk more about later - Binance also gets called out for its staking program, but it’s sort of buried amidst the numerous other charges it faces).

How many parties are involved?

Again, Binance has the advantage (or disadvantage, technically). Coinbase and its affiliated entity CGI are the only noted parties (defendants) in their case while for Binance, beyond the company itself, the founder (CZ) is personally held liable, and its two affiliates are also listed (BAM Management and BAM Trading). For Binance, the case also mentions two trust companies which have relationships with these affiliates and two other companies - Sigma Chain and Merit Peak Limited - which count CZ as their beneficial owner.

What’s with the Binance.us vs Binance matter?

This is a pretty interesting part of the case and I have some personal thoughts on this matter. In 2019, the US banned Binance from operating in the US. In response, Binance launched Binance.US which was supposed to be a separate company, established specifically to be compliant with US laws and the SEC’s expectations, and touted itself as independent of CZ. However, as a former crypto user and a former Binance user, I tested this out a year later (in 2020) and I’ve gone back to emails to confirm. Indeed, there was absolutely nothing stopping me from accessing Binance.com and no emails that were sent indicating that I needed to move to Binance.us. Only now, in 2023 many years later do I see that I cannot access Binance.com from the US. The case cites several examples that prove Binance.us was not independent, but this is just an example of lying or pretending to have followed the SEC’s ask and not even do a good job at it. From my perspective, it was an open secret that they were flouting the regulators. I can’t say I have much sympathy for Binance on this one.

What’s with the staking issues?

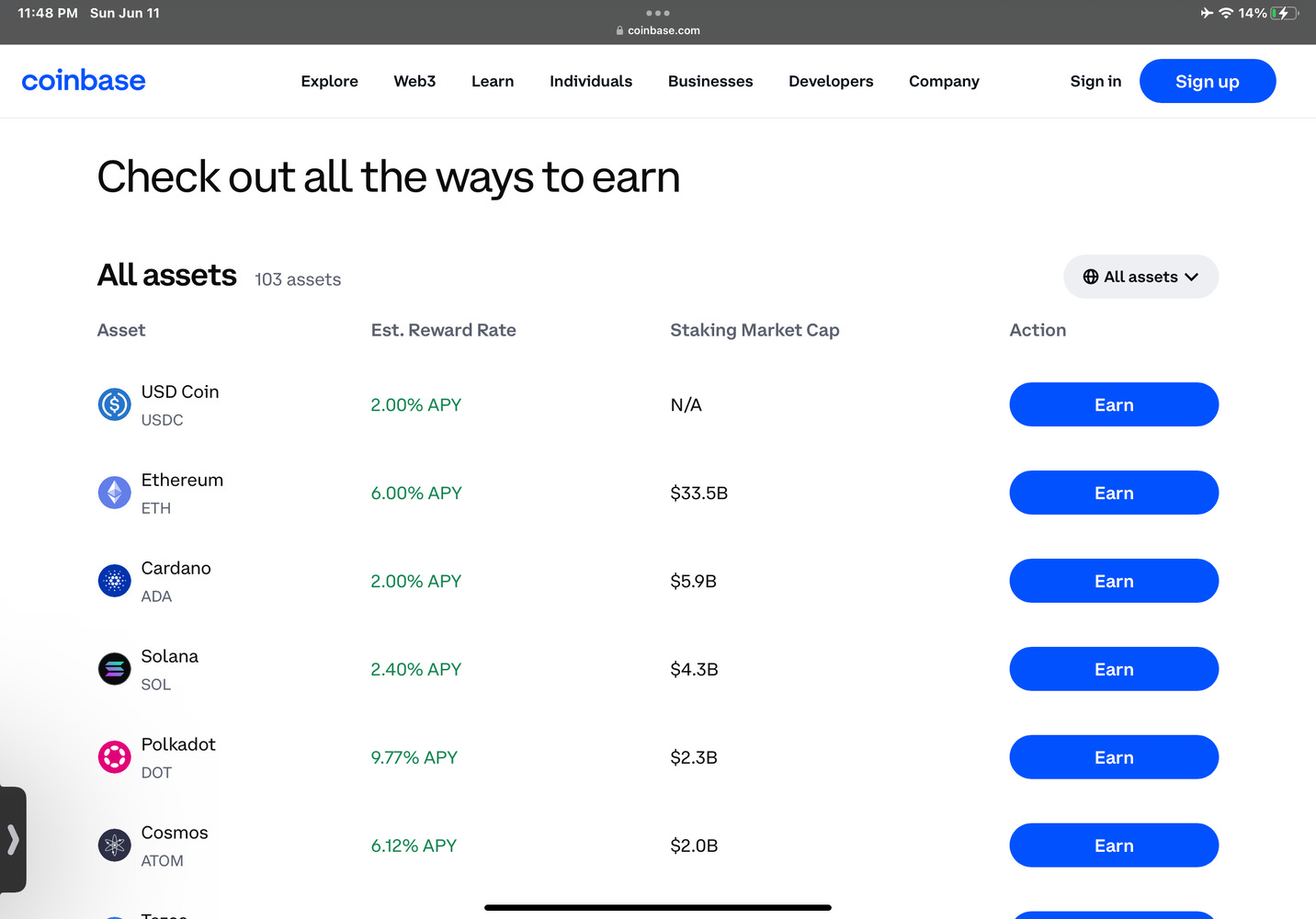

The SEC is using staking as another angle to claim that neither company properly registered with them, in this case not registering their staking programs with the SEC since staking the way they offer it is essentially an investment contract. Indeed, for the uninitiated, looking at staking, the first thought that comes to mind is interest-bearing accounts for deposits the way it is marketed.

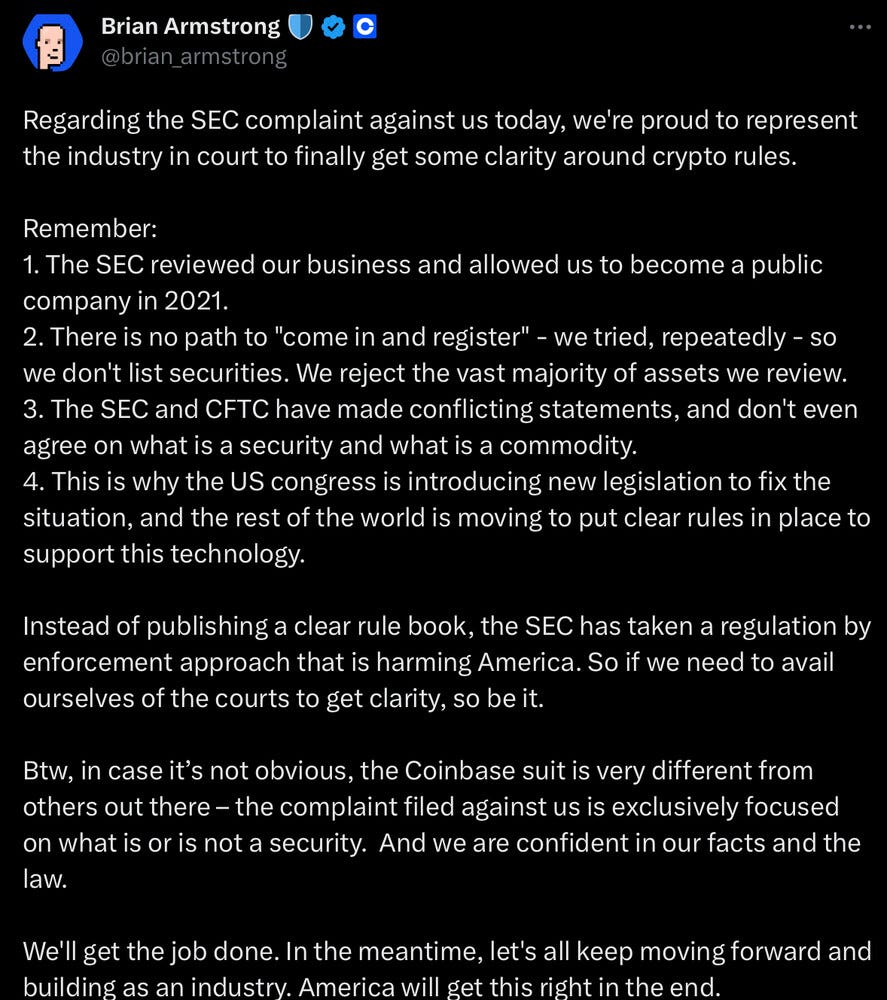

Both companies use interest-like terms like APY and they have rewards programs touted as part of the marketing. It’s important to note, this isn’t inherently illegal, but it’s the fact that this activity wasn’t registered which the SEC is calling out (which again, rewinding to the earlier part of this article and some of the outrage in the community, wasn’t clear to Coinbase based on their previous interactions with the SEC):

(You gotta admire Armstrong’s appeal to America, making it hilariously obvious he is trying to paint Binance as the foreign corrupt bad guy here).

If you’ve gotten this far and you are wondering what staking is, I’ll refer you to Coinbase’s excellent summary (which I will note has been carefully worded to ensure no mention of comparisons to investment accounts bearing interest) HERE.

Which tokens are involved in these cases?

Both cases have mention of SOL, ADA, MATIC, FIL, SAND, and AXS. For Binance, the SEC also references ATOM, MANA, ALGO and COTI. For Coinbase, the SEC references CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO. Noting the specific tokens is important because the SEC then proceeds to explain why each is token is a security by dissecting the background of each coin, some in more detail than others. It’s also interesting to note that the information used in each case in these sections is identical where the same coin is covered. Clearly interdepartmental coordination is happening here.

The impact on the coins cited here is beginning to be felt. While there was no outright collapse that occurred in their prices, there has been a clear drop since both cases were filed not just for these coins but for the cryptocurrency market in general.

What’s the juiciest thing in these cases?

Now that we’ve got the main particulars addressed, our deep dive revealed some interesting insights for both companies:

Binance ex CCO Samuel Lim admitting “We do not want Binance.com to be regulated ever.” - this seems really bad at first, but you could consider this as passable given those of us who work in payments and with money transmitter or payment aggregator licenses know that not all businesses or products are regulated - and this is a direct result of central bank requirements in various countries (or lack of therewith), along with having to meet certain volume criteria before regulation actually kicks in. Saying outright that you don’t want a business to be regulated isn’t inherently wrong in and of itself when you view it in that context.

Binance ex CCO Samuel Lim stating “We are operating as a fkng unlicensed securities exchange in the US bro.” - This statement is a whole different ballgame. The point of the SEC including this admission from the CCO is to demonstrate that leaders at the company knew they were actually offering securities and chose not to register them willingly. It’s hard to find any excuse for stating this and then not actually doing something about it.

An internal consultant at Binance mentioned that the company should issue a regulatory framework from within the company, and then take up the SEC’s time with no real expectation of doing anything fruitful and solely to get them to essentially become distracted from filing enforcement. That’s….yeah.

Binance’s auditor Armanino called out the commingling of funds issue in 2022, and when Binance didn’t take action on it, they moved on at the end of the year. The auditor they replaced them with, Mazars, elected to halt all crypto work (not just for Binance) just weeks after agreeing to work with them. So in essence, Binance had no auditor in place at the time this case was filed. Granted, Binance isn’t a public company so having an independent auditor isn’t a requirement, but still - pretty wild.

The SEC uses Coinbase’s own words against itself by showing numerous examples where they acknowledged the SEC’s assertion that crypto assets were securities, including by means of releasing its own “Crypto Asset Framework” and co-founding a “Crypto Rating Council” which aimed to try and rate which tokens were closer to securities than not, based on the SEC’s own guidance, all the while not actually doing anything to delist those that were actually considered securities by their own CRC ratings. They also call out the fact that this assertion was made on their previously cited S-1 when Coinbase was preparing to IPO.

What next?

There isn’t really much else as juicy on the Coinbase end beyond the last bullet (as CEO Brian Armstrong will make sure you note based on the tweet shared above). Regardless, both cases will go to court and we’ll see how things develop. Does this mean the end of crypto in the US? Who knows - upon this case being filed, Robinhood (not mentioned, but probably worried they could be next) has since decided to delist three crypto tokens and Binance.us has stopped accepting US dollar deposits. Coinbase, meanwhile, stands firm refusing to delist anything.

In conclusion - as things heat up with these cases, let us hope that whether you are a crypto advocate or an interested party of any kind, that the consumer is better off in the end, because ultimately that’s what it should be all about.

~~~~~

Apologies for the very late posting on this. You can review the case filings here - Binance and here - Coinbase. As you can probably imagine, our review of the FDIC, FRB and OCC’s new third party risk management guidance will be postponed to tomorrow. The SEC’s drops were quite a doozy! See you then.