Fintech Horror Stories - The fallout of BOA’s PPP loan handling

A lot of people might have “moved on” from COVID-19, but PPP lawsuits are heating up.

(Experimenting with different days and times of publication - please pardon our dust, and hope you enjoy this edition of our newsletter!)

May 11, 2023 - an important day, as it marks the date on which the US federal government intends to let the state of emergency (due to the COVID-19 pandemic) expire. A lot has happened in the last 3+ years since the global pandemic began, and there’s a lot to reflect on, but this is a newsletter focused on fintech - banking, payments, and other dimensions of the space. In this edition of Fintech Horror Stories, we’ll focus on the fallout of PPP, the program that emerged as a result of the pandemic, specific to Bank of America. This is especially relevant now in light of the news that BOA is getting sued for its handling of PPP loans and communication to small business customers related to these loans and payments due (link to the full lawsuit here).

A bit of a refresh - the PPP stands for the Paycheck Protection Program, which was launched immediately after the pandemic shut everything down in the US, spinning out of the CARES Act, signed into law on March 27, 2020. The goal was to help small businesses and other non-corporate/independent organizations/entities continue to pay their workers by leveraging existing lenders to provide small business loans. The idea was that the Small Business Administration would operate on behalf of the federal government, and partner with private lenders aka banks, credit unions, or other SBA-approved lenders. Applicants could file with these financial institutions for a loan and the funding would come from the CARES Act funding. There were several rounds of CARES Act funding, with the first $349 billion getting disbursed in the first half of April 2020. Another $320 billion was approved in late April 2020, with an expansion of the program occurring in June 2020 and another $759 billion allocated. There were various other extensions/permutations/enhancements that occurred after this time up until March 31, 2021, but for the purposes of this article, let’s focus on the first round, and Bank of America.

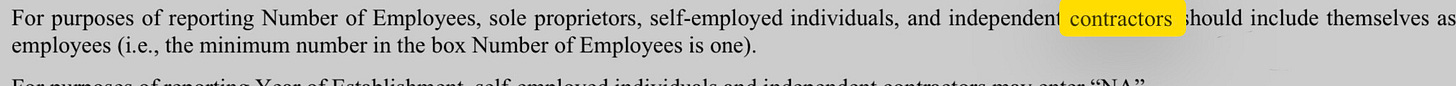

One of the key provisions of the PPP program was that the loans could be partially or fully forgiven if the business didn’t lay off employees or reduce their wages (thus proving the need/value of the loan and turning it into more of a grant). There was one nuance that had to do with 1099 workers/independent contractors employed by some of these businesses; and it was the important clarification that 1099 employees should not be included in a small business’ payroll calculations for their PPP loans. Since they are independent and their own business/sole proprietors, so to speak, they were to apply on their own:

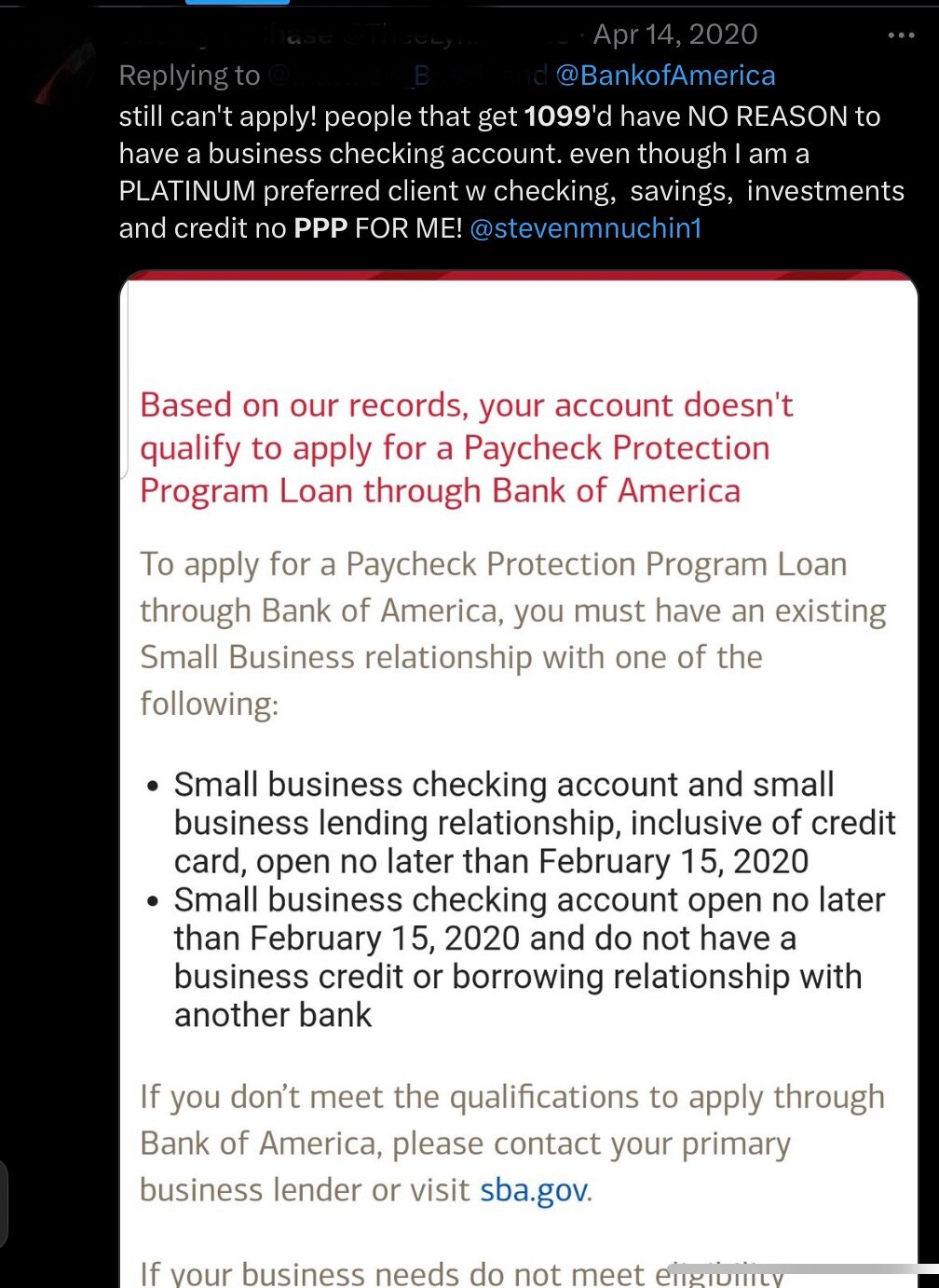

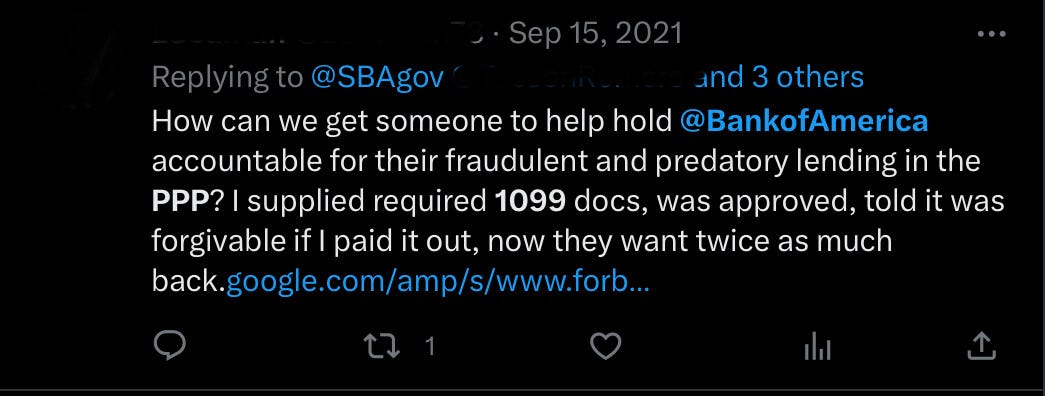

Bank of America, however, did not seem to get the message (and seems to stand alone, uniquely as such - more on that later). They appear to have deliberately instructed their PPP borrowers/applicants to include 1099 workers/independent contractors in their employee counts, thus increasing the amount that the businesses thought they could not only get loaned but ultimately forgiven. We have found various examples of where it turned out not only were businesses getting hit up by BOA to pay back loans they thought would be forgiven, but 1099 workers were being denied loans and being directed to seek relief from their employers from the very outset - here’s a few tweets speaking to the matter from upset business owners/independent contractors:

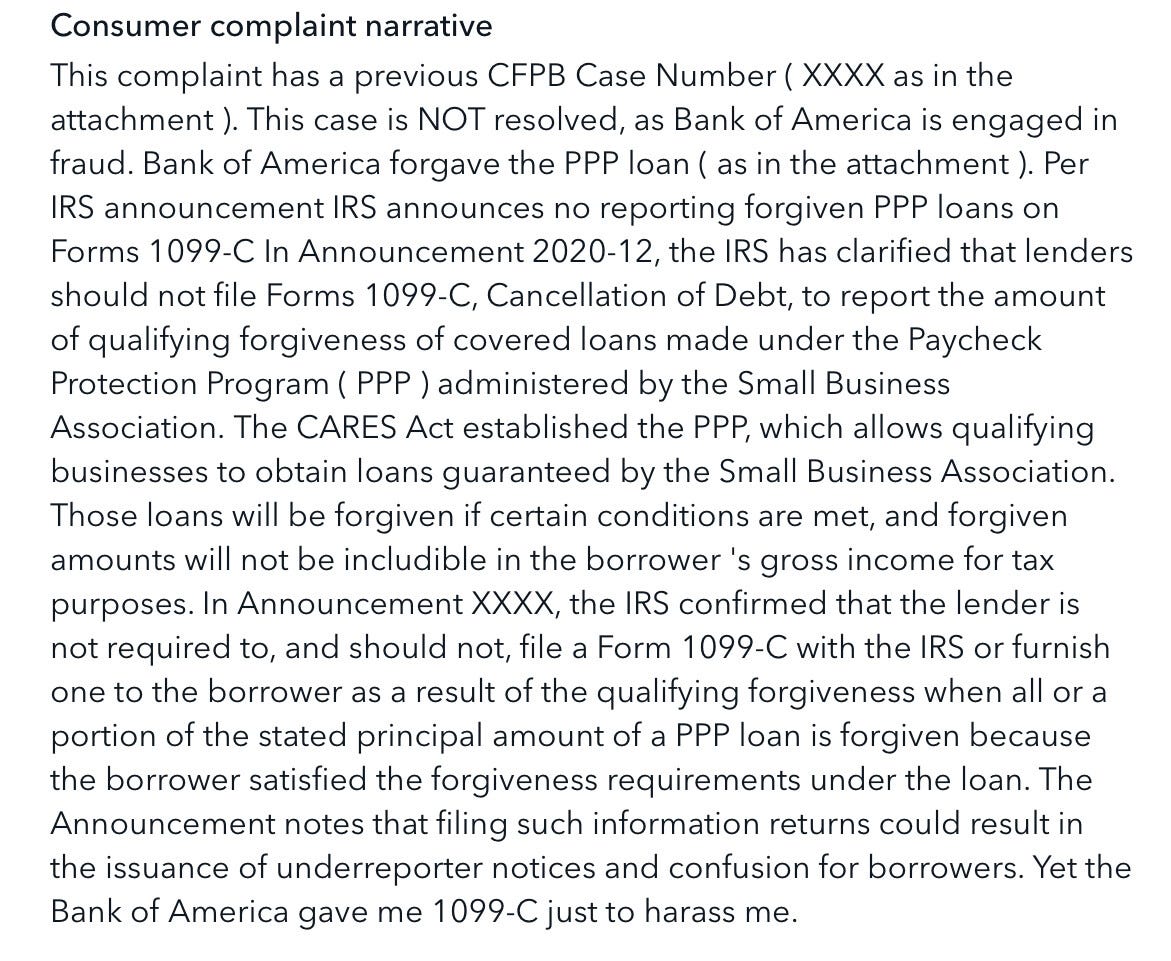

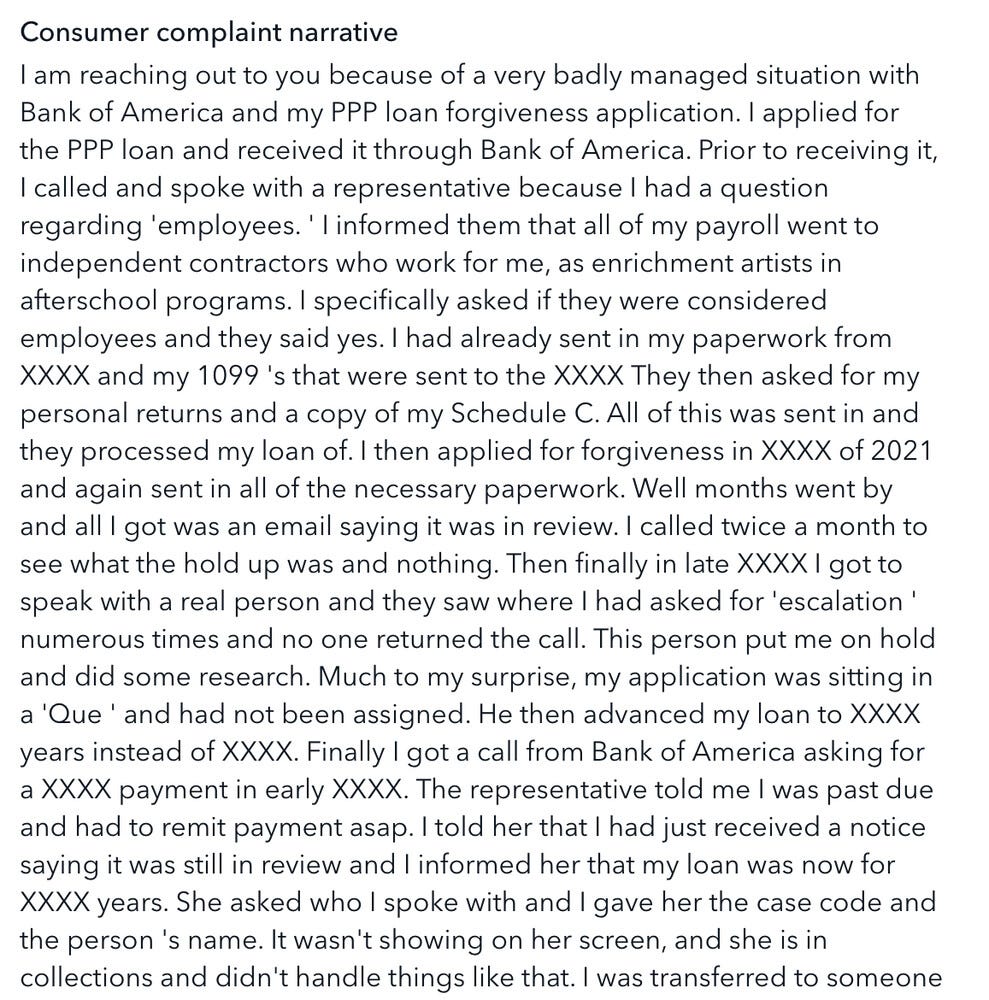

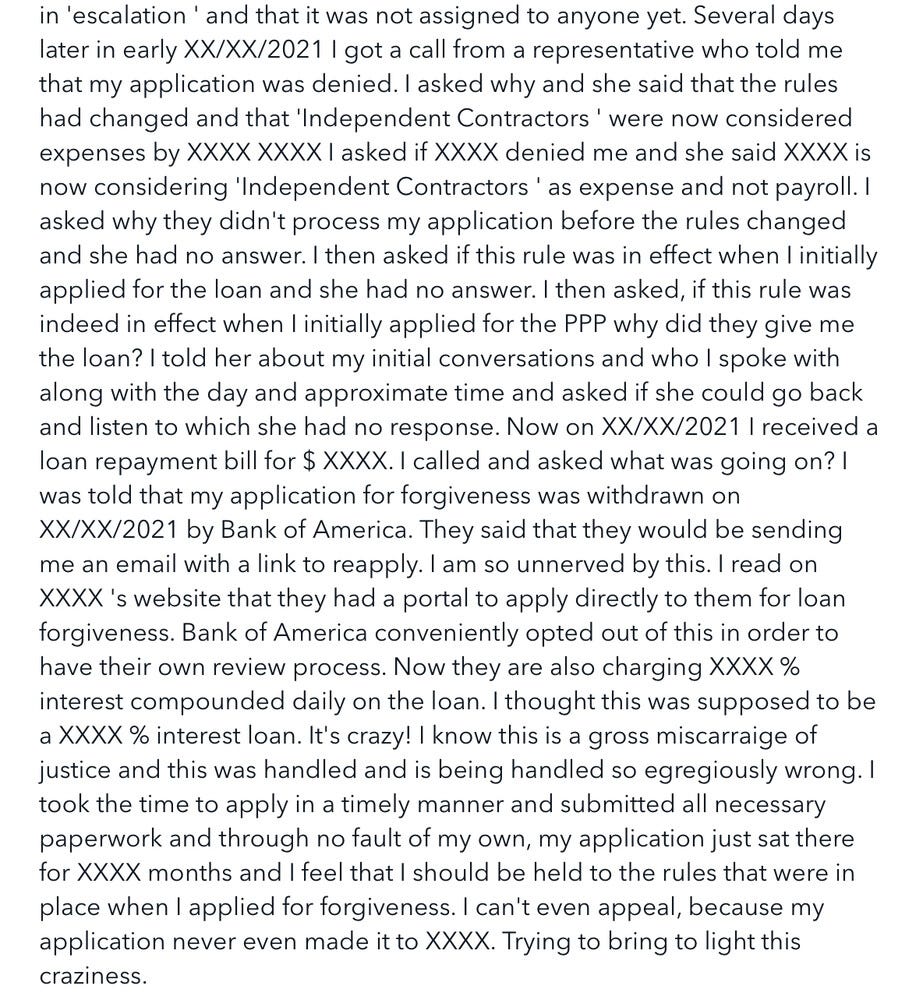

…along with various complaints filed with the CFPB:

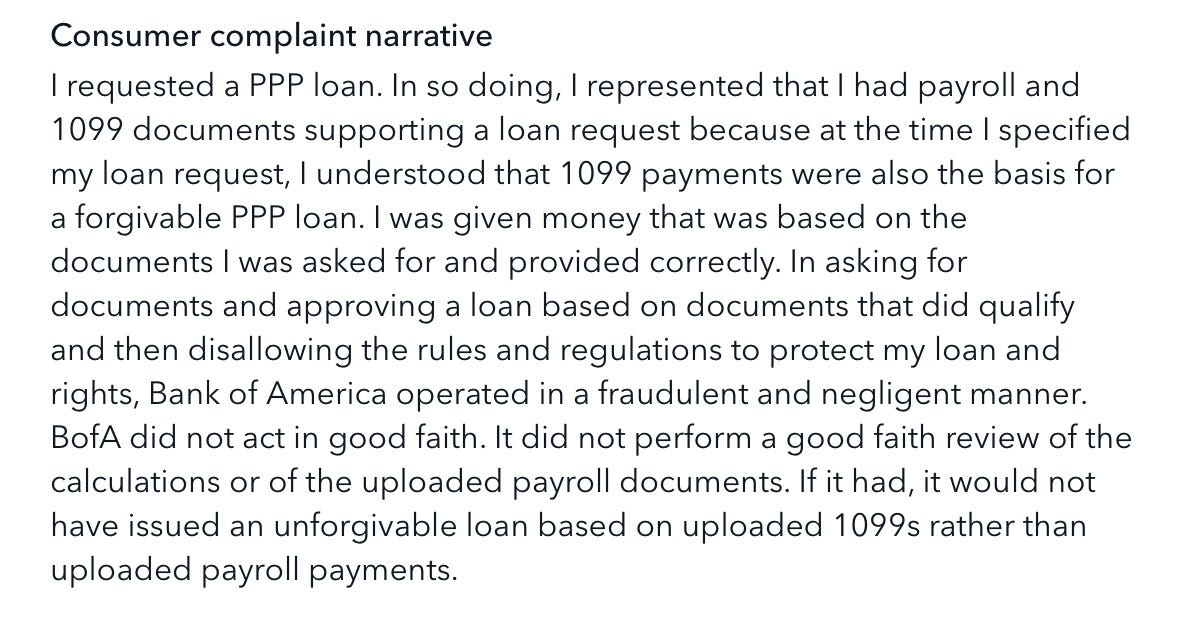

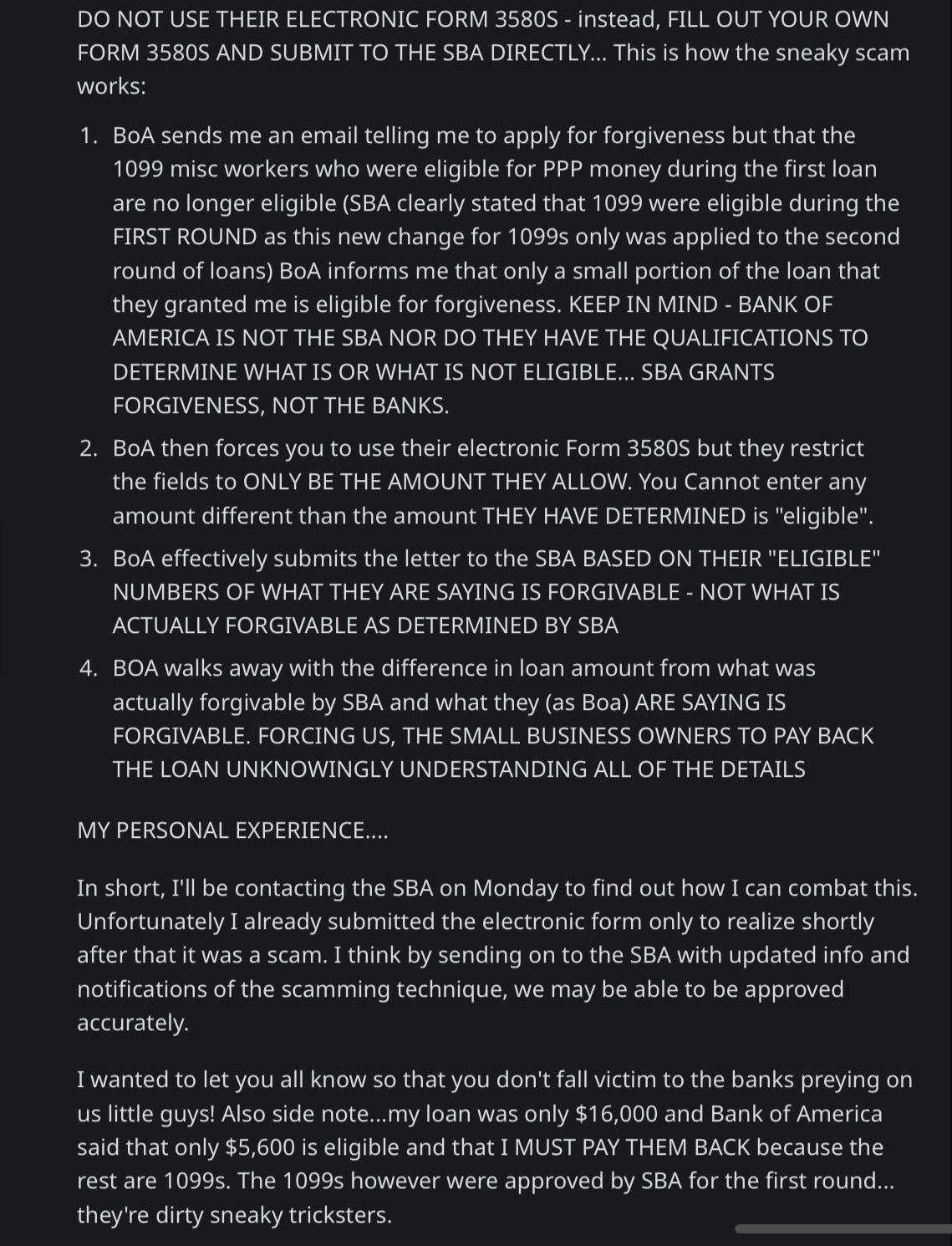

…along with posts on REDDIT, of all places:

The last comment drives home the ultimate impact of what this handling may have done to some business owners. But how did BOA stand alone? Simply put, through the fact that they misrepresented the SBA guidance to their lenders around 1099 workers, stating explicitly in their guidance to business lenders that they could apply for loans that included payroll for 1099s. These complaints/experiences shared above are unique to BOA and have almost no corresponding versions tied to other institutions, large or small (we looked). You can get a better sense based on reading the above of the rude awakening these borrowers got when, months after getting loans from BOA, instead of having the full amount forgiven, they are hit back up to repay almost all of it.

Are there other cases we can look to in order to get a sense of whether this is an isolated incident? Well, this is not the first class action filed against BOA regarding PPP and 1099 workers, with a previous one coming in August 2022 (which BOA is trying to get dismissed and shifted to arbitration, likely in light of this new class action, updates here). This also invites a closer look at the history of Bank of America’s small business lending product and whether it’s been mired in court cases before. It’s the biggest business lender in the US, and yet here it stands alone in how it handled these loans in what is likely the most critical moment in the business lives of numerous amounts of customers. There are 3 previous cases of note, well before the pandemic, that give an idea of some of the legal discourse around BOA and their small business borrowers. In one case, Bank of America v. All About Drapes, Inc., BOA filed a case against a business claiming that it needed to be paid for outstanding/delinquent loans, however the courts ruled against them ultimately holding that because BOA changed the maturity date without the borrower’s consent, the borrower is released from the debt. In a slightly more high profile case, Bank of America v. Barry Real Estate Companies, BOA tried to go after artwork (including an expensive Warhol) owned by some borrowers to satisfy an outstanding loan dating back over five years, but ultimately dropped the case that same year (unclear whether this was settled or if BOA just gave up). Finally, a case in the ‘90s, Lewis v. Bank of America, included a borrower suing BOA because he believed they misrepresented to him that a withdrawal he made from one of his accounts was from a tax deferred IRA when in fact it was from a 401(K), a fact that he realized when the IRS came calling to the tune of almost $700,000 - the courts ultimately sided with BOA after an appeal.

Are these cases just coming with the territory of being the largest lender, or should these have been warning signs for the SBA before they placed trust in the hands of private lenders (not just BOA)? Looking to the future, could 1099 workers who were denied PPP loans and loan forgiveness from BOA be next to file lawsuits? One thing’s for sure, whether fair or not - the relationship between banks and their customers is frayed and a lot of trust has been lost especially after the pandemic. This opened doors for fintechs to try and woo frustrated banking customers, but it will be interesting to see whether the pendulum swings back given the state of the economy in 2023 and the near future.