Fintech Horror Stories - Big Banks’ Customer Service on Twitter

This week we focus on HSBC UK, Santander Spain, and Bank of America

This week in Fintech Horror Stories, we spend time visiting with some of the biggest banks in the world, specifically with their customer service pages on Twitter. Everything we’ve talked about over the last few weeks in previous editions of this newsletter in terms of consumer frustrations - the stakes, the regulatory issues, etc - is amplified numerous times over with these behemoths. As we’re still figuring out the right approach for this publication, nothing is set in stone but it may follow that going forward, once a month we will dedicate some time to picking out consumer frustrations with these larger institutions in a round-up style format. Let us know in the comments if you agree.

A preamble of sorts before we begin - it’s important to remember that big banks have a lot of resources at their disposal. They have talent, they have data, they have technology, and they have the ability to send out communications to current and prospective customers, for service-related and promotional-related purposes - all at a level and scale that smaller fintechs, credit unions and regional players simply cannot match. So with that being the case, it’s hard to understand why some of the following issues occur. In my mind, the only explanations that make sense are:

A) The bank has become too big - with the end result being either i) its various departments that play a role in the end to end consumer experience are siloed and do not talk to one another ii) the bank has so much data on its hands but doesn’t know what to do with it or how to organize/monitor/respond to it iii) the bank is spending more of its resources and energy at the end of the customer lifecycle rather than the middle or start, pursuing fraud and delinquencies rather than acquisition and portfolio management

B) The bank is willfully ignoring these issues because they know the customer has no alternative and the regulators will just give them a slap on the wrist at most, relatively speaking

C) The bank doesn’t actually care for its consumer business since it doesn’t bring in any money relative to its other offerings namely wealth management and business banking, and is just a PR campaign. The real above and beyond service is happening in the white glove treatment those customers are getting, and they don’t take to Twitter because they never have any worries about getting in touch with someone.

With that bleak introduction out of the way, let’s dive into some interactions occurring over the last few weeks:

#1 - HSBC

Some background on this tweet. Jim runs a YouTube channel with 4 million subscribers. His twitter account has over 100K followers. His voice goes farther than what a single individual could do. He’s not a customer but rather someone who surfaces scams for the benefit of the public. The outcome?

It took 3 days and the Tweet to blow up with around 5300 likes and 170K views for this conversation to happen. Some cynical points raised by the audience (which is surprisingly well informed about banking operations, probably a result of staying connected with channels like Jim’s):

—The bank may be going out of its way to not invite reports of fraud because it would trigger them having to complete a Suspicious Activity Report, as required by anti-money laundering regulations. HSBC has been hit with fines in the UK for AML in the past.

—“Amplifiers” like Jim and others should establish working relationships with regulatory bodies and consumer advocacy groups that have jurisdiction over these banks.

—It is really inconceivable that the bank appears to have an insular process that only allows their agents to interact with their customers and not take input from non-customers.

Not much I can add to the above, so I’ll just point out that fraud is skyrocketing as of the end of 2022, and that in its financial statements as of the end of 2021, HSBC emphasized that:

a) 99% of its agents were trained in financial crime

b) the rise in fraud was mostly due to the pandemic and the circumstances it created for a rise in scammers

c) it had invested in AI based tools to better get ahead of fraud.

I’d love to see a follow up in the pending financials for year-end 2022 on these items; shareholders and customers should demand some kind of progress report to ensure accountability. Based on this experience, it’s worth questioning how effective these measures have been.

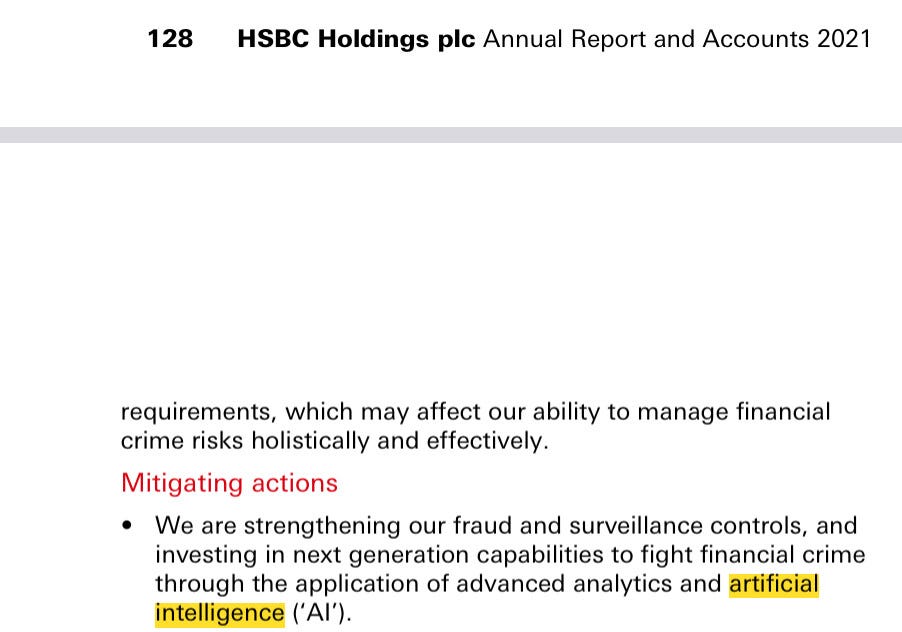

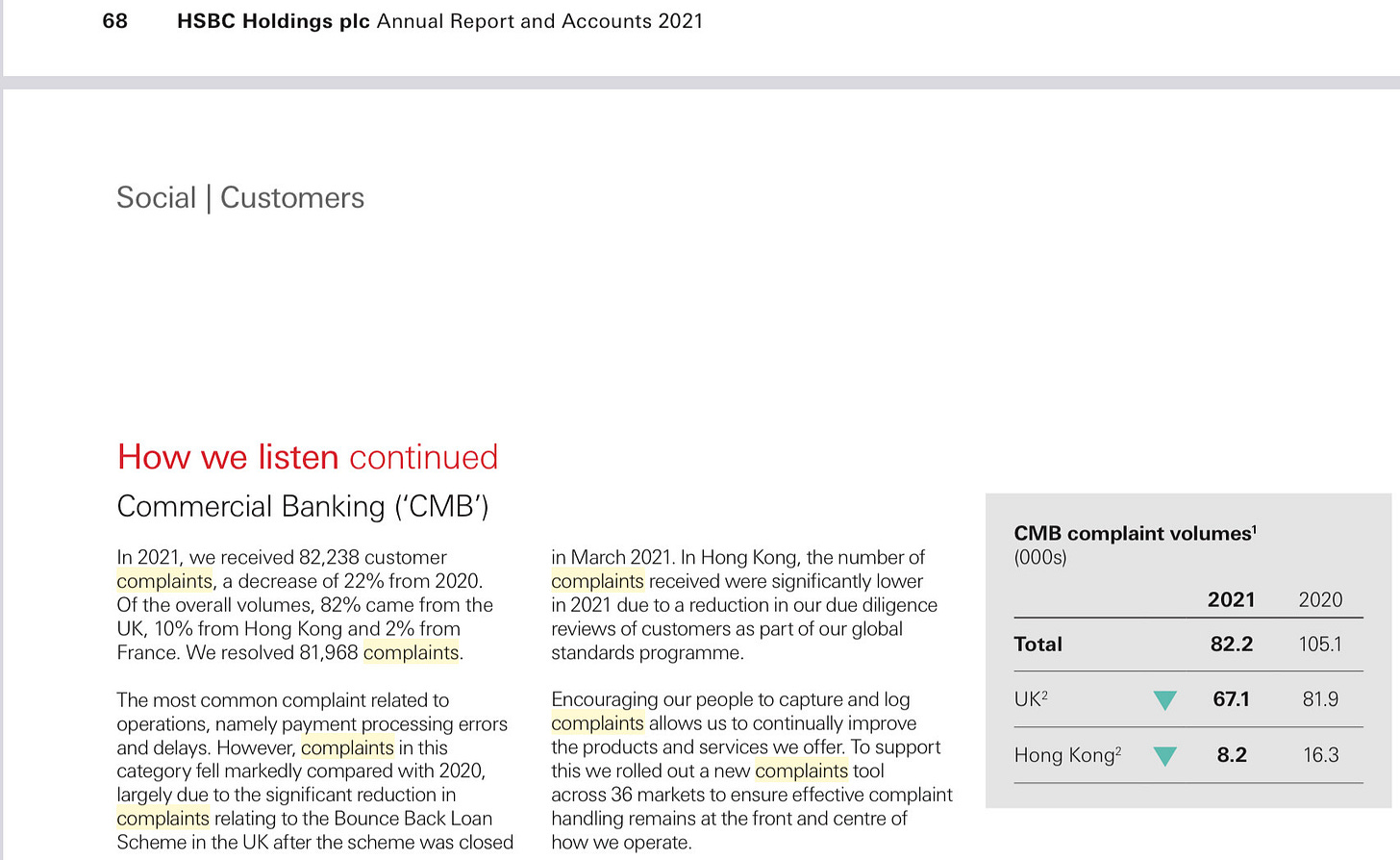

With that said, major props to them for highlighting consumer complaints in a dedicated section in the annual report:

#2 - Santander

This is the beginning of outreach to Santander’s Spain-based customer service handle. You can view the full thread here - in essence, this customer and their coworkers are commercial artists and live in the same community. Like the HSBC example, this particular account is also relatively well-known, with around 30K followers.

They purchased a renters’ insurance product provided by the bank and then experienced a combination of disasters - black mold, power loss, roof collapsing on them - and while they are getting support from the community and its insurance provider, there is a lack of responsiveness from Santander and the insurance company they engaged to service their customers. To be precise, one month of waiting to process the claim. At first, there seems to be some sign of hope as the Santander customer service account responds:

However it’s all for naught as 3 hours later, the customer reports back that they are going to have move out and sue them due to no meaningful response:

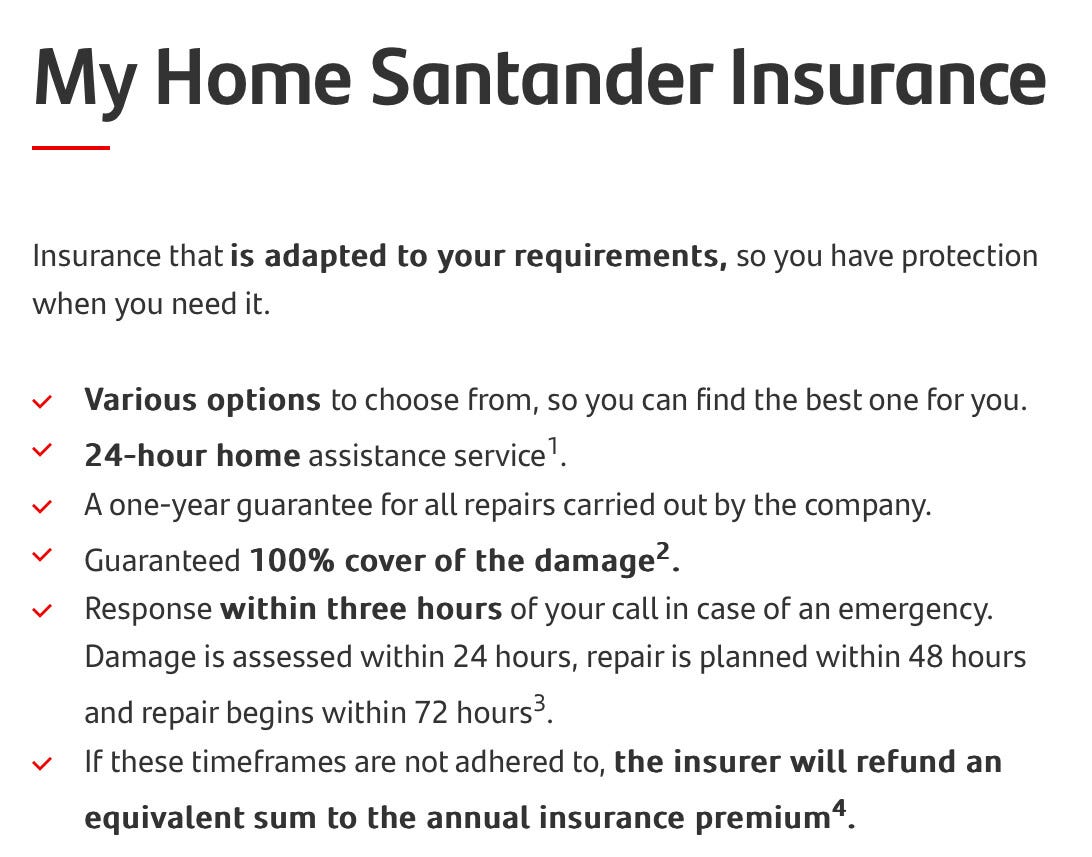

I decided to take a look at the page where Santander offers this insurance and selected the option as though I was a tenant. The details are interesting (translated from Spanish):

The SLAs don’t appear to have been adhered to and it’s unclear whether the refund was provided. Interestingly, a search for the insurance company mentioned by the customer (Velmer) reveals nothing on the list of providers shared by Santander:

It’s really hard to figure out the exact details of what happened here without more information, but it’s clear the ball was dropped by either Santander, the insurance company or both. The only takeaway is that this isn’t a highly regarded product based on several metrics. The app that provides the insurance services has a 2.5 rating on the Apple Play Store:

They also found a way to have the search result misrepresent their service as having a 4.7 rating when it is in fact the rating of the review site (Roams)

Given the last condition of the insurance (regarding refunds if terms are not met), I’d be interested to see how much money they are making on fees vs how much in refunds they are paying out for untimely claim resolution…

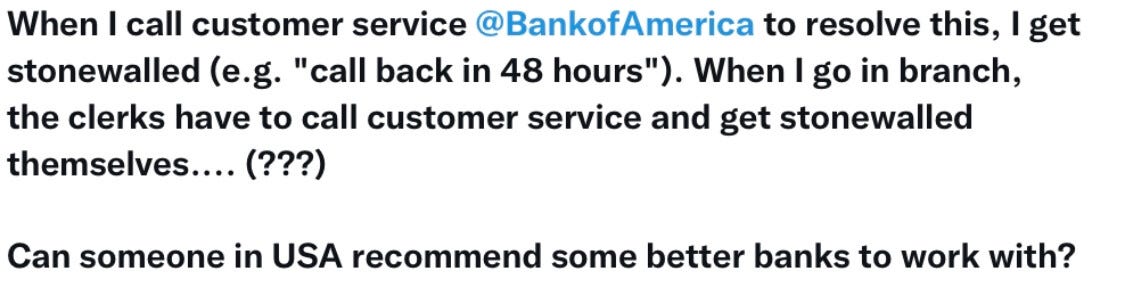

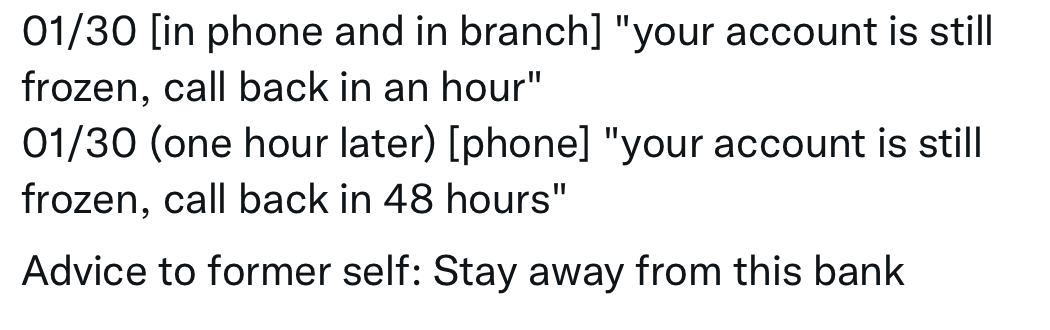

#3 - Bank of America

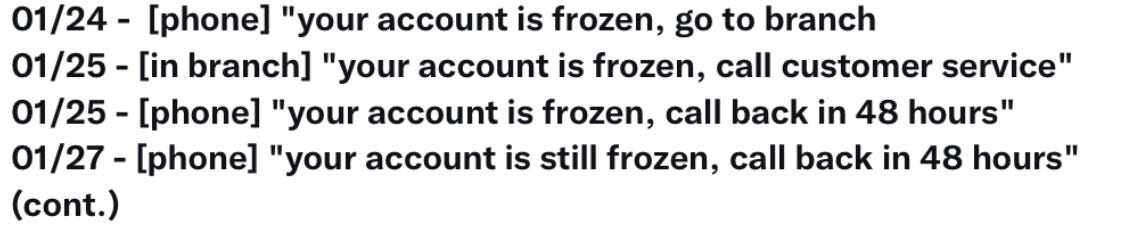

This example is fairly self-explanatory:

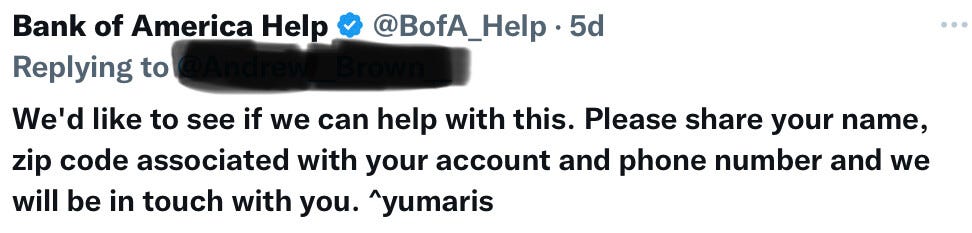

Some hope on the horizon with one response from BOA:

But a few days later, the customer comes back with another update:

BOA jumps back in again:

But where’s the link?

And it ends there. Unfortunate for this immigrant and his wife to have to deal with this upon their arrival in the US. This just comes down to lack of responsiveness. Simple as that.

In closing, this is all really unfortunate based on the three examples shared. However, it opens up a good lane for credit unions and fintechs to thrive in. If you’re in this category and are thinking about what you’re going to lead with to try and grow your startup or small bank, start with customer service (and not just as a byproduct of whatever innovation you have in mind). The big institutions like these are (unfortunately) making it easy and it’s a pretty simple yet incredible opportunity.