Fintech Horror Stories - Bank of America’s Expensive Offers

When chasing dollars turns into you being the one chased.

Bank of America, the second largest bank in the US, is back in the news as it got hit with not one but two consent orders from the Consumer Financial Protection Bureau this past week. In studying the first order, it’s maddening to see just how much deception appears to be going on particularly in the marketing and servicing. And what’s wild, based on some follow-up work we did, is that this is appearing to continue to this day even as the order comes out. We’ll take a look at the second consent order next week (focusing exclusively on fees), but this week we’re going to dig into the first one which has to do with offers.

First, an overview of what’s involved here. BOA, just like J.P. Morgan and others, runs cash bonus offers for opening new accounts, whether for credit cards or deposits. For many customers who are desperate for cash, this is a great way to make some money especially with credit cards, where you don’t have to spend anything. I can’t say I’ve ever taken advantage of these offers before, but I can see how they could be appealing for many. The time involved during which the CFPB identified these offers as being deceptive dates back to 2012, and the CFPB has already called out the bank for similar behavior in the past ($23 million)

Here’s an example of one of these ads (actually still ongoing today):

Today, the ad also has added the following disclaimer:

But back then, this did not exist (which is why the CFPB has cited UDAAP (unfair, deceptive and abusive acts and practices) something they frequently monitor as part of their regulatory oversight). The CFPB in the consent order cited that the fact that the offer was only available online was unclear, and that customers who went to retail centers and called over the phone to apply for the card were never told that they weren’t eligible for the offer. Looking at this example from today, to be frank, I still think the disclaimer is lacking as it doesn’t say anything about the offer not being available if the customer calls. While from experience, I can say that the heavy majority of consumers will apply for cards like this online, there’s always a small population of folks who still like to do their banking in-person or over the phone, and I’ve noticed that they tend to skew towards the elderly (bringing into question whether there’s potential for elder abuse here and not just your typical shady promotion). In any case, I find it quite ironic that in the channels where customers actually interacted with a human, where all the opportunity for clarity existed (which isn’t always the case online), none of the agents bothered to tell the consumers that they weren’t eligible for the promotion.

And that leads to the next part of the CFPB’s order - incentive compensation. Many banks and FIs that have sizable customer servicing functions tend to use sales-like commission/incentive structures with agents as a way to motivate them to drive goals. While one might argue that there’s nothing being “sold”, it turns out this is very much like the Wells Fargo situation where the incentive was to open as many new accounts as possible. You would think that BOA would have learned from a debacle that continues to haunt Wells to this day, but clearly it did not as the CFPB noted that they caught numerous instances of employees signing up customers without their permission for accounts (going further than not telling them about the fact that they weren’t eligible for the offers). This then triggers a series of events that creates even more pain for the customer - observe:

Step 1: Pitch the product to the customer or receive a call/visit from the customer asking about the product.

Step 2: Poorly explain or conveniently omit explaining that the customer cannot receive the offer through any means other than signing up online.

Step 3: If the customer didn’t sign up, then misinterpret (knowingly or unknowingly) their intentions and apply on their behalf for the card without their knowledge (this is the “fake accounts” scenario).

Step 4: In the process of the “fake account” being created, the customer’s credit report is subject to a hard pull.

Step 5: As many of these accounts have annual fees, they are incurred and when left unpaid, interest begins to accumulate along with late fees. (This is where Truth in Lending/Regulation Z comes into play).

Step 6: The credit report gets even worse and the accounts go to delinquency, with the customer probably finding out at this point. (This is where the Fair Credit Reporting Act comes into play).

Step 7: The customer has to waste time and money, potentially dealing with collections, and complain and escalate the issue on their own.

Step 8: Bank of America eventually realizes there’s a systematic problem and has to first do a refund validation project, then fix the credit reports of these consumers, and then create costly new controls around a process that could have been avoided if there had just been honesty and more clarity, in the marketing and by their agents; who would have likely done the right thing if they had received proper training and a better culture was created by their management.

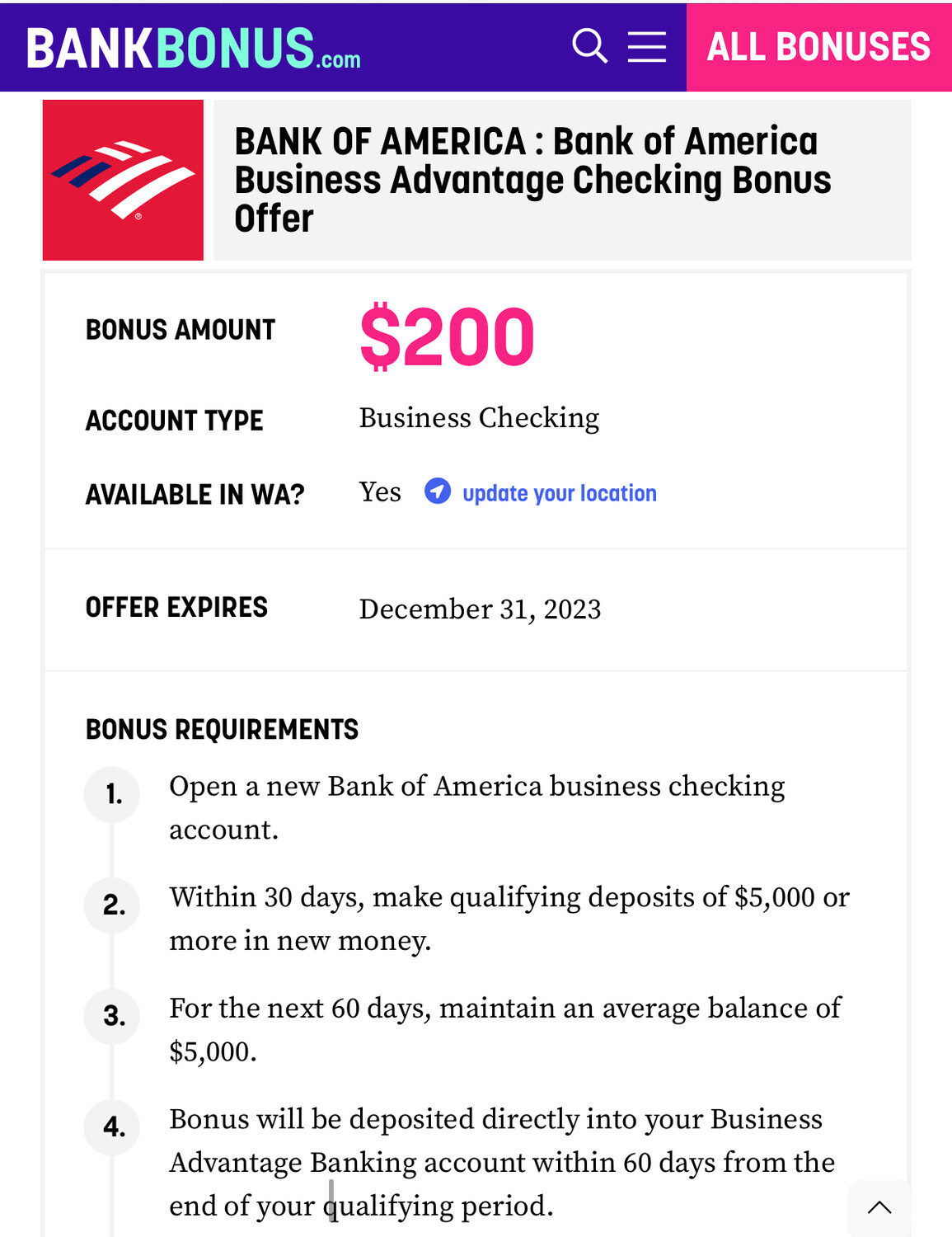

If that sounds exhausting, then imagine that being multiplied by a few thousands, and occurring in spite of the bank getting warned by the CFPB previously. And yet, even in spite of this consent order, you’d be surprised to learn that BOA still isn’t getting this right. Yes, we couldn’t resist digging in and found an example that continue to reveal the same issues occurring. Take a look at this $200 deposit offer, posted on the affiliate marketing website BankBonus.com:

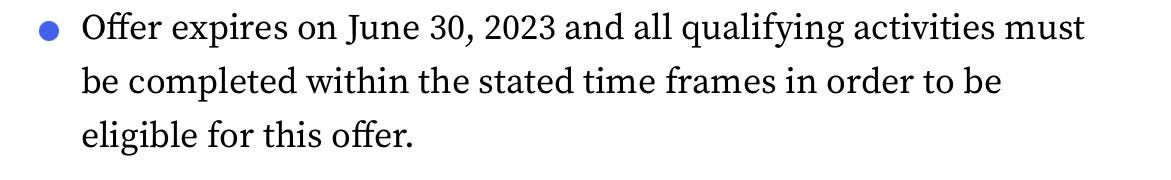

Looks innocuous enough. However, there’s a section with “further details”. Take a look at this:

There’s a clear discrepancy - on one hand, they are saying the offer expires on December 31, yet elsewhere, they are saying the offer expires on June 30. And before you say “this is the affiliate, it’s not BOA,” the CFPB has made it clear that errors/activities by affiliates on behalf of the financial institution they are working for, are ultimately the responsibility of the FI/bank itself. At a minimum, someone at BOA should have reviewed this (or if they did, they should have done a better job).

But wait, there’s more!

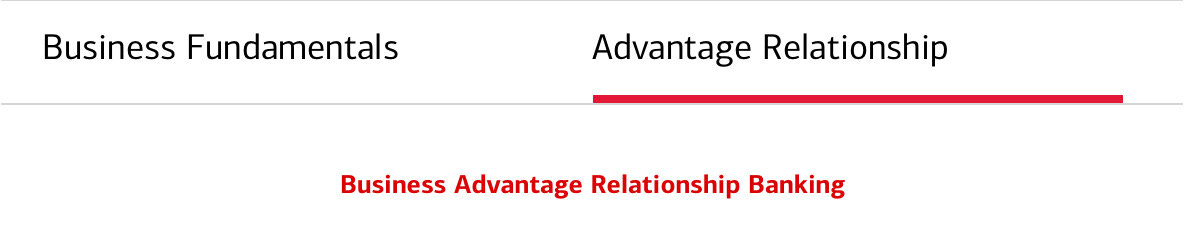

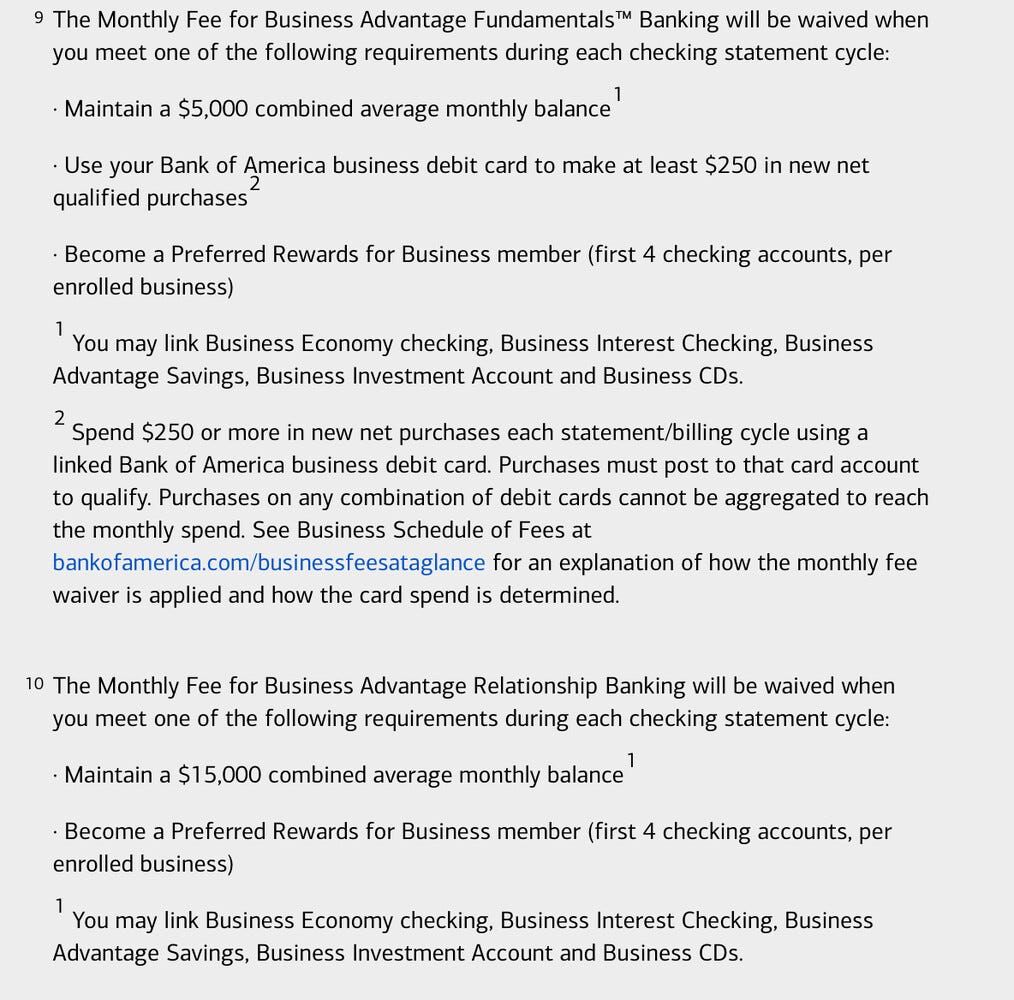

Note that in the first screenshot, the offer is saying that $5,000 needs to be held in order to get the $200 bonus. However, what the affiliate doesn’t tell you (and BOA does, albeit way way at the bottom) is that you need to pay a $15 monthly fee if your balance isn’t at least $15,000 if you go with the second type of account (there are two) - what makes it even more confusing is that one version of this account does indeed have the same $5,000 requirement as what is needed to get the bonus, but the other type has $15,000. It isn’t at all clear that there are even two types of accounts and if you are able to figure that out, you have to do a bit of thinking to figure out which is which:

Why wouldn’t they just call them “Advantage Fundamentals” and “Advantage Relationship?” This then makes it more confusing when the user reaches the fine print:

So imagine that you do get confused and end up signing up for the account that ends up getting you a $29.95 charge because you didn’t maintain $15,000. In the end, you don’t get a $200 bonus but with about 90 days of $30 fees, it ultimately gets cut to $100. And by the time you realize what has happened, if you don’t immediately shut the account down, by that point what you thought was going to be a great way to make some money has turned into a way to take money out of your pockets. At a minimum, the “$200 no matter what, just put $5000 in the account” affiliate marketing should be updated since it’s not entirely true.

Next week, we’ll take a look at the other consent order which is on the topic of “junk fees.” If you liked what you saw here, why don’t you give us a like and share this with others? Thanks for reading and have a nice weekend!