Fintech Horror Stories - Bad Behavior, Crypto Updates, and some exciting news!

Comic panel from “Banking Horror Stories #1” by Graham Sisk, for eco.com

Welcome back to this week’s newsletter! After an exhausting deep dive of recent regulatory actions, I thought it would be great to get back to the roots of this publication and dig into some classic horror stories that were sent to me by loyal readers Barb MacLean and C. Wallace - thanks to both of you for the tips! There are also a few other interesting updates to share this week including some crypto-related developments, so rather than focus in on one topic as is usually the case, I thought this week’s edition would follow a “quick hit/bites” format.

Plastk, the Secured Card that secures money from its own customers

I don’t even know where to begin with this one. Perhaps an overview of the main player involved might be helpful. Plastk Financial & Rewards Inc (Plastk Visa), a Canadian fintech, touts itself as an innovative company that provides secured cards to consumers, essentially as a way to repair their credit. They use Digital Commerce Bank to deposit secured funds and to issue Visa cards provided to consumers. They then help repair customers’ credit scores/profiles. They’ve even claimed to the be the “preferred secured credit card” of the Vancouver Canucks. Sounds innocent enough, except for the fact that a) they have gotten in a multi-year court tussle with their banking partner b) there’s almost no evidence of their being preferred by the Canucks or the NHL, aside from one ad that was featured on the rink during a single game (which incidentally was overshadowed by TD Bank logos everywhere) and c) they have a growing backlog of customer funds that they have not remitted, completely contrary to their terms of agreement. You can read more about this horrifying tale here (thanks, Barb!).

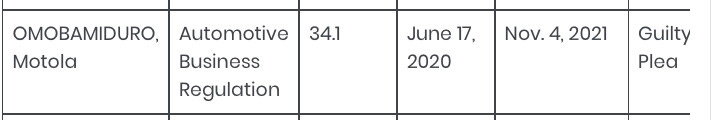

My take: This should raise some serious questions about non-regulated fintech entities and what rights consumers have while doing business with them in Canada. While it’s easy to say “they should have known better,” there are times when folks are desperate and will throw money at a problem in the hopes that it might solve the issue for them, not realizing that the money may never in fact come back whether intentionally or not. While this court case situation is touted by the CEO of the company as an excuse as to why the money is held up, a quick Google search would reveal this CEO’s legal issues prior to his involvement with this company (back in 2020) when he was in the automotive business - specifically, for violating Alberta’s Automotive Business Regulation section 34.1, which includes within it requirements around…wait for it…”paying out proceeds.”

Credit Suisse’s final hurrah

If you thought I had enough on the Credit Suisse beat and was going to go easy on them given they are going to soon be a part of UBS, think again. In Singapore, a court has ordered them to pay out over $900 million to the former prime minister of Georgia. The story goes that he invested $1.1 billion with them, and the relationship manager in essence completely mismanaged the funds. What makes it worse is that they approached him, and not the other way around.

My take: Sadly, this reminds me of those classic Law and Order episodes where the more sympathetic party is found guilty and the clearly dislikable party walks off victorious. Why? Well, the former prime minister is worth around $5 billion and while it’s a chunk of his net worth at stake here…he’s still a billionaire. Meanwhile, the former Credit Suisse banker in question who mishandled the funds (specifically, making bad investments) actually ended up killing himself in 2020. Yeah, this got dark quickly - still, you can piece the full story together here and here (thanks for the tip C!)

Crypto Updates

In crypto news, despite the doom and gloom that seemed to be imminent with last week’s SEC news that we reported on, it seems many companies are moving on undeterred (or at least following through on plans that were started before the SEC’s recent moves). On one side, BlackRock has filed to launch a bitcoin ETF, which is being reported as a big deal - primarily because they are using Coinbase as their custodian (primary function of securing institutional funds invested in crypto) when Coinbase is facing arguably its biggest regulatory challenge since its inception. On the other side, a new crypto exchange was launched by EDX Markets to much fanfare given who backed it - Citadel, Fidelity Digital Asset Services, Paradigm, Sequoia Capital, and Virtu Financial. The coins traded out the gate are BTC, ETH, LTC, and BTC Cash.

My take: Pretty gutsy especially for Blackrock which prides itself on its reputation and has decades of surviving numerous economic cycles, and is the household name in asset management. Arguably also gutsy for those other pretty reputable companies that invested in this new exchange via equity. One might also be baffled that Bitcoin’s price is increasing, and why the SEC moves don’t seem to be discouraging folks from participating in the space. However, this could all be part of a bigger sea change underway - a final cleansing of the sector so to speak, making way for the “dinosaurs” to take over the space in effect and help it “grow up,” while doing away with “bad actors” like Binance and Coinbase (or at least significantly reducing their clout in the space). The benefits of cryptocurrency, particularly in solving numerous money movement issue, cannot be denied. But neither can the fraud and identity (AML/KYC) issues. Having “adults in the room” will likely result in massive changes - whether they are for the better or whether this is all just clearing the way for us to get to a CBDC-led world remains to be seen.

Exciting News

I’m very pleased to announce that this humble newsletter is going to be at Money20/20 in Las Vegas this October! “Fintech Horror Stories” has been graciously granted a press pass and will be in attendance all four days. You can expect interviews, recaps, analysis, and more as we descend upon what is arguably the biggest fintech industry conference in the world. If you’re going to be there, please reach out!

Until next time…