Fintech Horror Stories - A Slice of (Customer) Life

This week’s story comes from India, focused on the unicorn startup Slice.

This week’s horror story seems to be a great symbol for what has happened to the world of fintech. Started off with a lot of promise, compelling founder, got huge bags of money, then getting in legal hurdles and while seemingly compliant on the surface, having core customer service collapse to the point of non-responsiveness and from there…well, you all know the drill.

It’s a feel-good story (at first, at least in this article). Slice was started by a young, twenty-something budding Indian entrepreneur, Rajan Bajaj, who had the right kind of experience, with a degree from IIT and a stint at Flipkart, followed by a short-lived furniture startup that he launched. He then launched the first iteration of Slice, “SlicePay,” as a Buy Now Pay Later service provider in 2016 but the idea wasn’t working. Then in 2019, he decided to issue a physical card targeted to young consumers and success came knocking. 29 investors, 12 funding rounds, and $258M of funding with a billion dollar valuation later things are looking good for them. With a founder who says things like “We are just trying to do the right things for the customer in the simplest possible manner in the fastest possible way and trying to give back their time. We are removing that complexity and making their life simpler and better,” what could possibly be wrong?

The answer, as usual, lies in the customer experience. At first, feedback seems to be pretty solid:

Now granted this seems to be when the card was still in pilot mode, but there’s just one problem (detected by savvy users a year later):

Oops.

It’s worth pausing here to explain how Slice works. It’s targeted towards young Indians, including college students, who don’t have much of a credit history and don’t have experience with typical banks or credit cards. Lots of good stuff to like at first - Slice has an app which you can use to track expenses, build a repayment schedule, and overall it has no fees, along with what gives the product its namesake (the ability to spread out or “slice” your card payments for three months for free with no interest) - this last part is what places it as a BNPL offering. It also has a 2% cash back rewards program.

How does the card work on the back-end? The student/user has to submit their college ID, proof of address, and proof of identification (equivalent of SSN here in the states) to complete KYC. Slice reviews information from the customer’s social platforms, different from banks which use CIBIL (credit scores for Indians) and other financial service related data, which in this case this demographic doesn’t have. (More at this link). So on the surface it seems this is a huge financial inclusion play! Expanding access to credit to the unbanked! What’s wrong with that?

Their credit practices are where most of the trouble seems to lie. The company offered a credit line that varied depending on your punctuality with payments, and initially offered equated monthly installments or EMIs (for an example of something similar, see “equal monthly payments” offered by Amazon on their Prime Rewards Card). However, in May of this past year they changed to “only allow select customers with a good credit score or repayment history to use its Pay-in-3 feature.” The reason why? “With such a huge customer base of sub-prime and new-to-credit customers, the company was seeing faster revenue erosion.” Also: “We are going to completely shift our focus from just providing credit to an exclusive set of customers to providing overall payments going forward. Strategically, this is a priority that we want to focus on for the coming years.” Finally: “Collections for repayment of dues was also a challenge that they are working on.”

The woes increased when Google Play Store privacy settings alerted users that an update for Slice’s Android app rolled out in June had excessive access to their photos, audio recordings, and call history. While Slice was able to work with Google to sort out the warning and adjust the app’s settings within hours, it was yet another unneeded example of bad publicity.

Customers then started to talk about a change that officially went into effect on July 1 (which based on what we gathered from the linked discussion, was not clearly disclosed for prospective customers until after they had signed up and only appears after you make your first transaction apparently) but didn’t seem to be properly announced until days later.

As noted in the terms shared above, the change was moving from underwriting once at the beginning and reporting only once to the bureaus (albeit for the full amount of the credit line) to seemingly reviewing every transaction for creditworthiness.

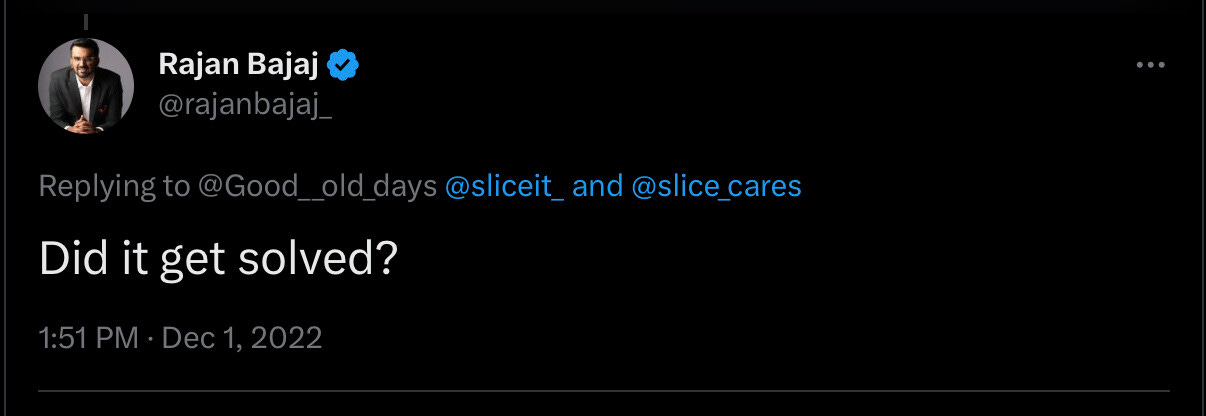

In the subsequent announcement, which came in the form of a notice to customers, Slice refused to explain that this was in response to an RBI (Indian regulator) circular that said non-bank fintechs like Slice could not provide credit lines and thus Slice had to shift to this loan-based model. Slice even gave it a name, calling it “Purchase Power.” I give them credit for trying to own the moment and act as though this was an example of innovation rather than a response to a regulator. But judging from many of these responses, people don’t seem to be experiencing any Power at all and it’s damaging their credit:

These aren’t personal loans, yet because at the end of the day this is essentially a BNPL product disguised as a credit card, it would seem every transaction was still getting structured as a separate loan, something Slice had outright denied when presented with the evidence previously (and saying that if it happened, it was an error and they could correct it):

In spite of the comment above, post-July they seemed to just be vague and unclear about this as they rolled out the new RBI-driven Purchase Power product. Although posters at the aforementioned site noted emails from the CEO and customer service that showed they continued to assert that credit scores wouldn’t be impacted and multiple loans wouldn’t show up in credit reports, there were no more publicly visible references for these claims. We also have those exact scenarios continuing to happen in the aforementioned tweets we highlighted with the first occurring in November.

The final demise for Slice’s original concept of a credit-card-that-was-not-really-a-card-but-a-BNPL-card-hybrid came with another RBI circular effective in the beginning of December. This time, the RBI banned third parties that were not true lenders and were actually prepaid issuers from having any sort of credit lines in them or anything that resembled one (i.e. the loan product that they had just launched). In response, Slice shut down its original card for a month (as in, straight up blocked/prevented customers from using it - talk about taking any and all steps to achieve compliance!), and re-launched a revamped product in early December. This time, after getting a license from the RBI, the card was changed yet again to be a true prepaid card, while the lending was moved to a separate experience called “Slice Borrow.” But what differentiates this from the original, failed first version of the company that was just a BNPL lender? If the BNPL/card hybrid doesn’t work, then what is special about this product? Based on the above, it’s tempting to think, “well, the regulators forced their hand with all these circulars.” But wait, there’s more!

Focusing on the CEO, Rajan Bajaj - while his story noted previously is motivating, his Twitter feed paints a picture that becomes relevant later on. It’s full of pep talk, observations about the startups, occasional interactions with others in his space, but almost zero interactions with his customers. There are only two instances I could find where he does:

We referenced this earlier, but in one, he starts a “Twitter Thread”around February to explain why Slice’s credit reporting process will not damage a customer’s credit score and how Slice does not report multiple credit lines. And then, when someone claims it does and shows screenshots, he says “we have been rectifying it for the impacted ones” and “rest assured, it doesn’t impact the credit score of these users.” Yet as previously mentioned, in early July, when they changed the lending/underwriting policy they only privately reiterated to customers there was no impact to folks’ credit scores while publicly did not comment/affirm this - Bajaj’s only comments at that time were just tweets about creating great songs, humans having “thought chains,” and advice on how to win (“think locally”).

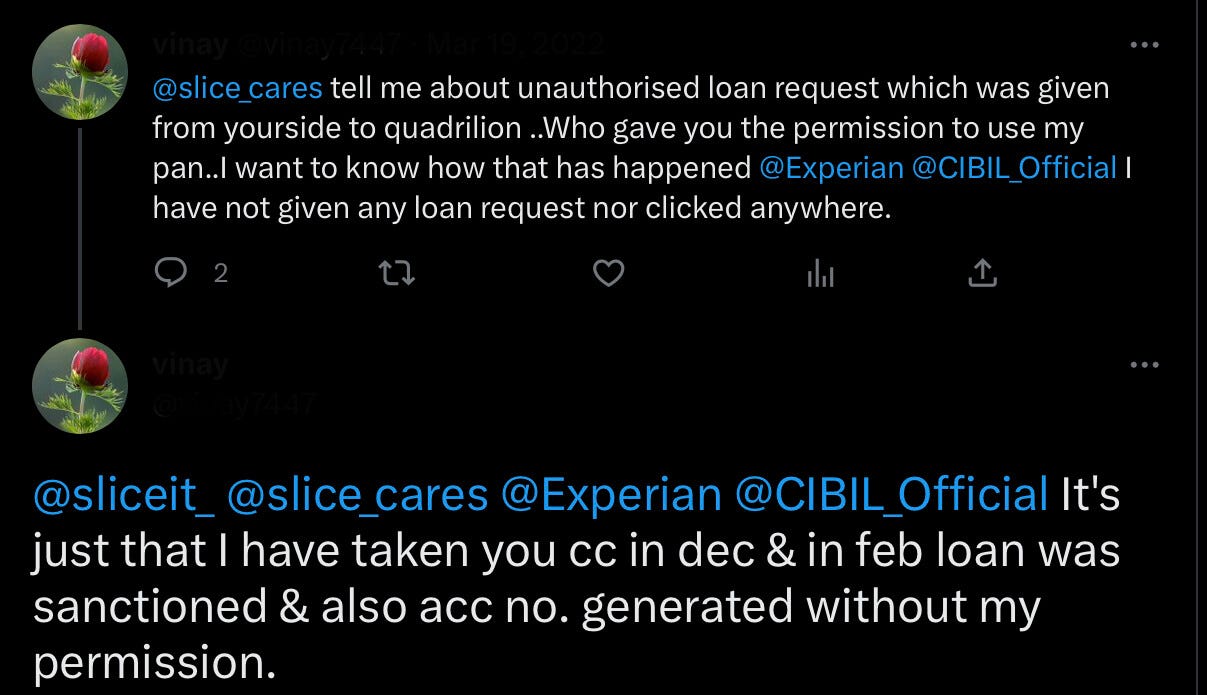

The other? Months later, after numerous changes, he finally responds to a customer (whose issue we can’t see due to the tweet/account being deleted) and just asks “did it get solved”?

Based on the followup in the thread, it seems like it was not solved.

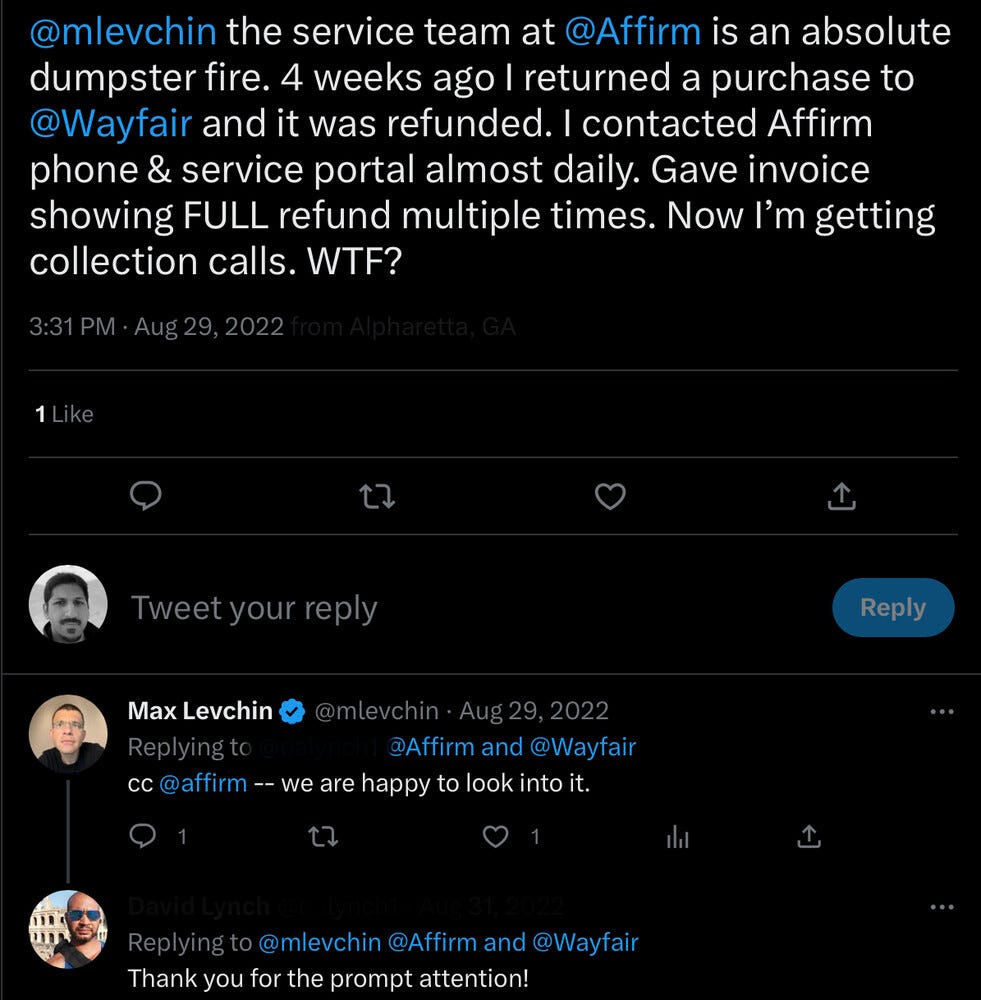

Compare this to other fintech startup CEOs like Max Levchin of Affirm, whose company is facing equally choppy BNPL waters lately yet still takes the time to step in and meaningfully interact with upset customers directly (and more than once or twice a year from our observation - the below are just a few examples):

All things considered, the future is not clear for Slice - Inc42 did a great job of breaking down the events noted above and digs into the financial state of the company, while we framed the events using customer reactions/impact. And that’s where we’ll close out in our final section here - initially, Slice had great consumer buzz as we noted above - some of which turned out to be paid/bought - but over 2022, things started to deteriorate amidst customer confusion.

To add some specifics, I reviewed the interactions with their customer service Twitter account in October 2022 and there were over 70 complaints in the full month. Jump to this past week (January 21-28) and there are over 250 in just one week alone. Most of these are about withdrawals and generally a lack of responsiveness. However, some of these are about debt collection.

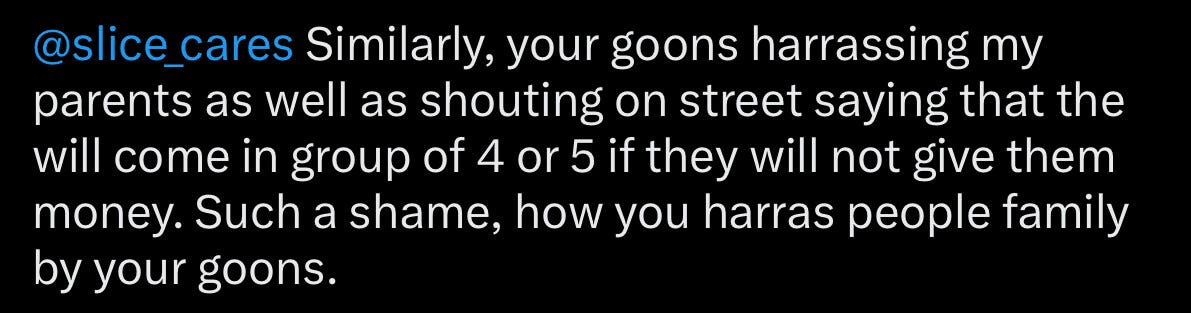

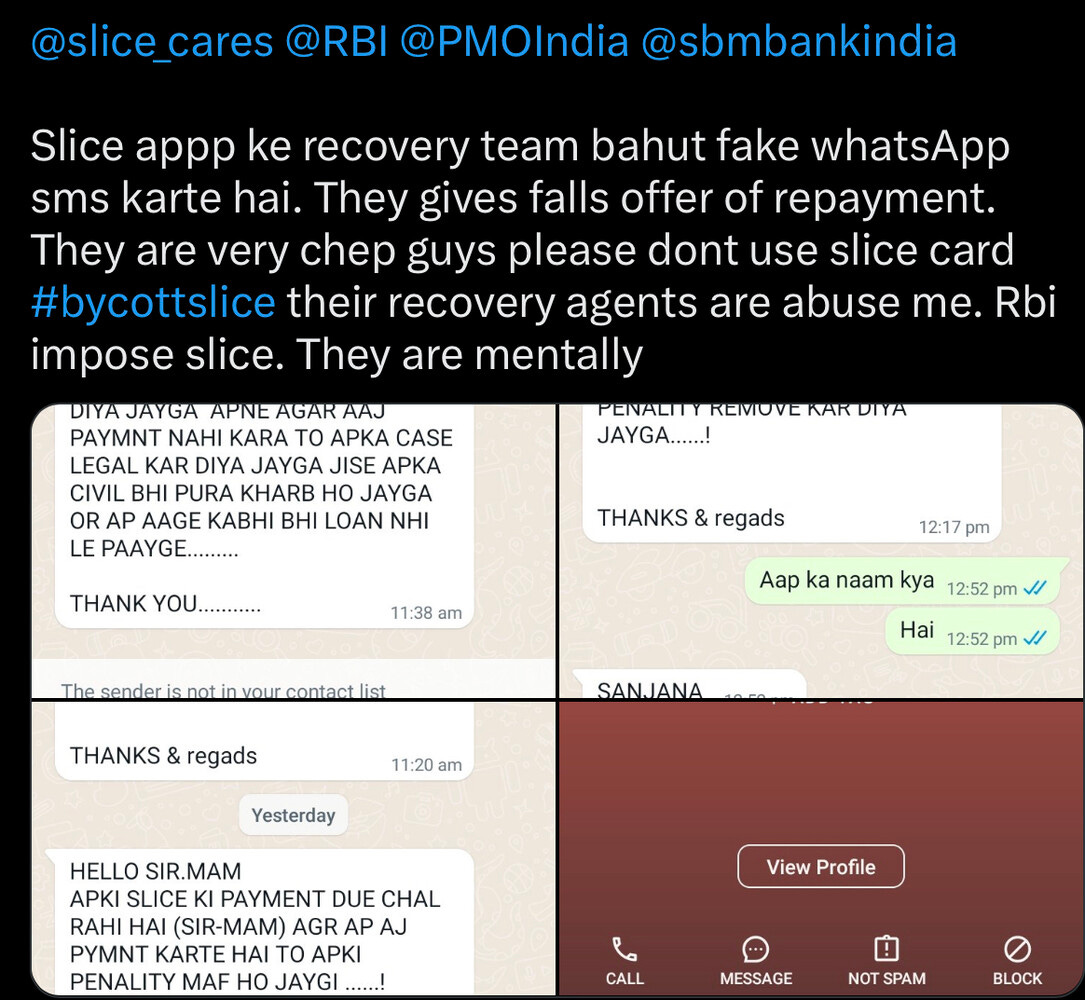

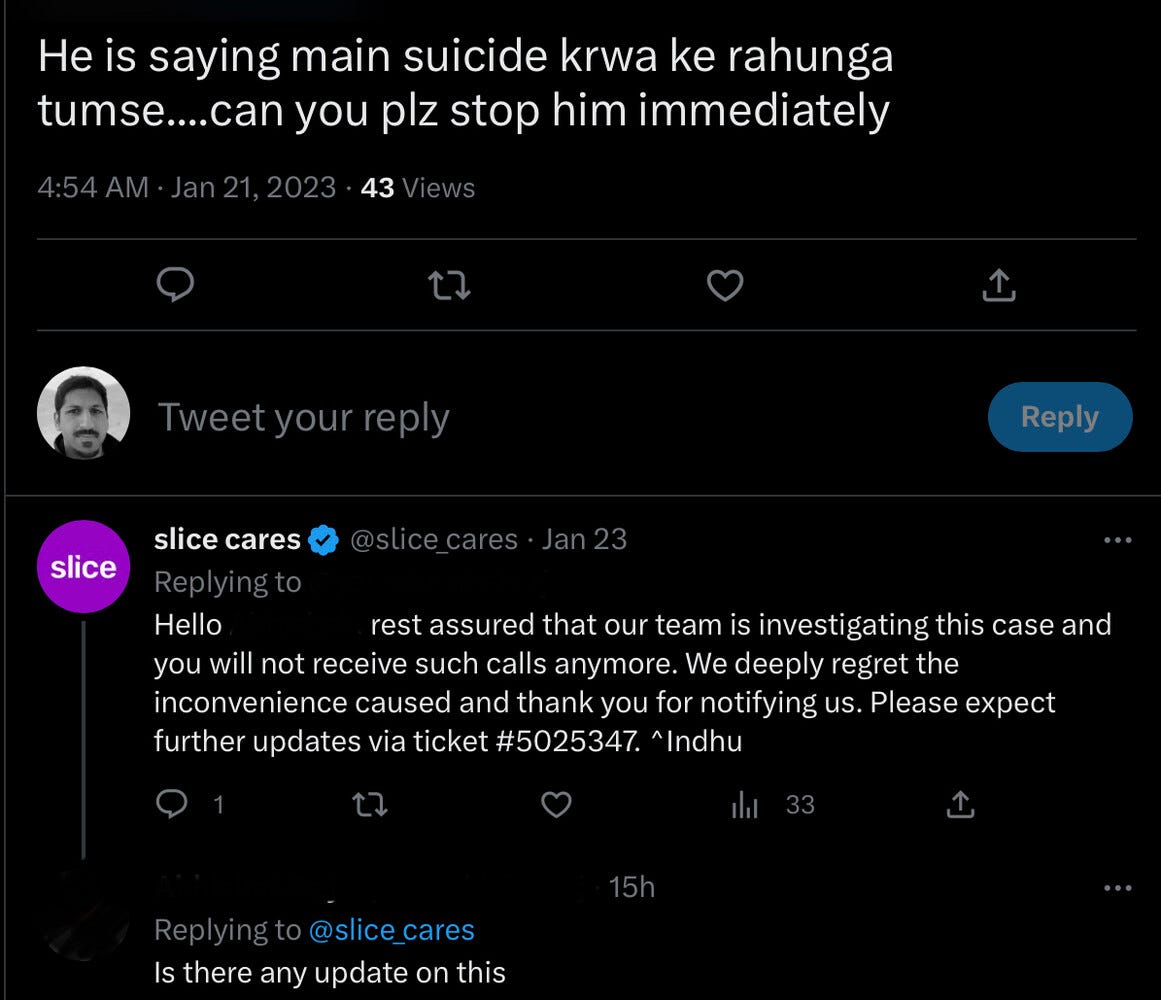

I hate to end it on a dark note, but nothing drives home the point about poor customer service more than when consumers are treated unfairly by collectors. While these issues are occurring in India and it would be easy to think “well, they don’t have consumer protections the way they US does,” the RBI does in fact have a pretty explicit circular around debt collection that talks about the manner in which consumers should be approached, including a prohibition on threats/harassment/intimidation. And yet, there are reports of that very thing happening with Slice customers in debt:

While these accounts can’t be verified and could certainly be part of an elaborate plan by a so-called-customer to get out of debt, they should at least spur some investigation (which Slice seems to have yet to initiate).